21+ Canadian Banking Statistics You Shouldn’t Miss

How big is the banking industry in the Great White North? What assets do Canadian banks hold?

If you want to get the answers to these and similar questions, then you’re in the right place. The Canadian banking statistics we’re about to walk you through will help you get an insight into the banking industry in Canada as a whole.

The thing is:

Banking is one of the most dominant and profitable industries in Canada. The country also has one of the safest banking systems in the world.

So, are you ready for a Canadian banking industry overview? Do you want to learn more about the Canadian banking index? Check out the latest Canadian banking trends below!

Canadian Banking Statistics that Will Blow Your Mind (Editor’s Choice)

- The market capitalization of the Royal Bank of Canada (RBC) is $132.52 billion.

- Canadian banks employ around 280,000 people.

- The Canadian commercial banking industry grew 8.9% per year on average between 2016 and 2020.

- 76% of Canadians use digital channels to conduct their banking transactions.

- The annual worth of the Canadian market is $111 billion.

- 56% of Canadians used mobile banking in 2018.

- RBC got 794 out of 1,000 points for customer satisfaction in 2020.

- The six largest banks in Canada have spent around $100 billion on technology since the 2008/2009 financial crisis.

General Canadian Banking Industry Statistics

1. The Canadian banking industry in 2021 will have a GDP growth of 4.5%.

(Source: Fitch Ratings)

According to the Fitch Ratings, entrepreneur and consumer activity will improve in 2021. Canadian banking facts show the outlook is stable, and banks will be able to retain the capital and liquidity required to finance a recovery of any case.

However, the financial performance of 2021 will be quite challenging because of the post-pandemic period. In 2020, mid-sized banks had to invest in technology urgently in order to stay on top of the game and outrun their competitors.

2. Canadian banks employ around 280,000 people, Canadian banking system facts reveal.

(Source: CBA)

The banking industry in Canada employs over a quarter million Canadians. In 2019, the banks and their subsidiaries paid around $30 billion in benefits and salaries. The diverse workforce is a particular asset.

Here’s the deal:

56.5% of employees in the six largest banks are women, and 37.5% are from visible minorities. People with disabilities are also represented, with 5.2%.

3. The banking industry in Canada is responsible for $65 billion or 3.5% of the country’s GDP.

(Source: CBA)

The banking industry is one of the essential contributing factors to the country’s economic growth. In 2019, banks spent over $21.8 billion on goods and services from outside suppliers and paid $12.7 billion in taxes, which makes them some of the largest taxpayers in the country.

What’s more:

They are long-time contributors to charities and non-profit organizations and groups that help support programs in the areas of education, arts, environment, youth, healthcare, and disaster relief.

4. 84% of Canadians have a positive view of the banking industry.

(Source: Abacus Data)

Canadian banking association statistics show 87% of Canadians believe the banks are secure, and 70% think the banks are honest with their customers.

The Canadian Bankers Association was founded in Montreal in 1891 to lobby on behalf of the banking industry and advocate for effective public policies. CBA members include the five largest banks, as well as Canadian subsidiaries of foreign banks and smaller domestic banks.

5. Canadian banks donated more than $22 million to support front-line workers.

(Source: CBA)

As the social and economic disruption caused by the COVID-19 pandemic continues, Canadian banks have proved that they stand by their customers, helping them with mortgage flexibility. They have also helped with credit card payment deferrals and waived more than $100 million in fees for many small business and personal accounts.

The Canadian Banking Market in 2020

6. The “Big Five” dominate the Canadian banking industry, holding trillions of dollars in total assets.

(Source: Banking Canada)

The term “Big Five” is used to describe the five largest banks in Canada – the Royal Bank of Canada, the Toronto-Dominion Bank, Bank of Montreal, Bank of Nova Scotia and the Canadian Imperial Bank of Commerce.

These banks’ headquarters are in Toronto, and they all operate under government charter. As of December 2020, the big five banks in Canada market share is over 85%.

7. The annual worth of the banking market is $142 billion.

(Source: Visual Capitalist)

Widely considered as one of the safest, the Canadian banking system plays an important role in the country’s economy. With a large share on the market, the Canadian banking system values stability over experimentation. This is in contrast to the US, where the banking system is more open to experimentation.

Here’s the deal:

One of the biggest differences in the Canadian banking system vs the American one is the market share. While the largest five banks in Canada have a whopping 85% market share, the largest five in the US hold only 35%. Click To Tweet8. Between 2016 and 2020, the commercial banking annualized market size growth was 8.9%.

(Source: IBISWorld)

The market size of commercial banking is increasing fast. In 2021, it’s forecast to increase by around 4.9%. Commercial banking trends Canada for 2021 suggest the market size of commercial banking, measured by revenue, will reach an impressive $251.9 billion.

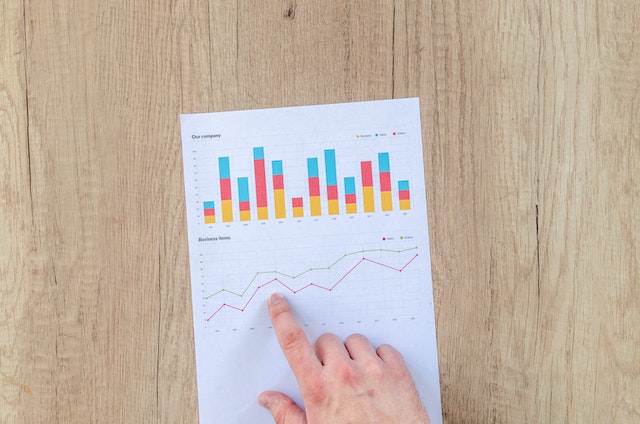

Canadian Online Banking Statistics for 2020 and Beyond

9. 76% of Canadians use digital channels (mobile and online) to conduct their banking transactions.

(Source: CBA)

Online banking has become the most common form of banking, with over 88% of Canadians using it in the past year. And as technology constantly grows, Canadian digital banking expectations are rising.

What’s more:

Online banks in Canada are the number one method that 53% of Canadians are using.

85% of Canadians trust online banks, known for their strong reputation of stability and their focus on privacy and security. Click To Tweet10. More than half of Millennials (54%) will increase their use of mobile app banking in the next five years.

(Source: CBA)

The second method is mobile app-based banking, which is rapidly gaining momentum, as cell phone statistics reveal. In fact, 36% of Millennials say apps are their main banking method. Since most Canadian own a smartphone, that number is expected to rise even more in the next five years.

11. 91% of Canadians believe banking is a lot easier thanks to new technologies.

(Source: CBA)

Canadian digital banking trends reveal the majority of Canadians are relying on online banking systems now more than ever. In fact, nearly nine in ten Canadians report they used online banking in 2018. Also, online banking is the preferred method of doing transactions and accessing their bank’s services for more than half of Canadians.

12. Up to 56% of Canadians used mobile banking in 2018.

(Source: CBA)

This was a considerable increase from the 2016 and 2014 surveys. In fact, about 32% of financial transactions in 2018 were done by mobile phones. The percentage is expected to rise to 41% in five years.

Also, when it comes to using mobile banking technology, mobile banking stats for Canada show Millennials are three times more reliant on mobile banking than Boomers.

13. The largest banks in Canada have spent around $100 billion on technology since the 2008/2009 financial crisis.

(Source: Crowdfund Insider)

With the onset of the pandemic, the Canadian economy started to shrink. But that didn’t stop the largest banks from investing in IT infrastructure that provides digital banking. The six largest banks in Canada are spending over $13 billion annually on tech upgrades and cybersecurity.

Now:

These costs account for about 9% of their revenue and 15% of their annual operating expenses. It is expected that the banks will invest even more, since the COVID-19 crisis is still present. As a result, new customers continue to sign up for online banking services.

14. 99% of Canadians have a bank account with some financial institution.

(Source: CBA)

Canadians have many choices when it comes to account packages. There are probably over 100 different packages to choose from in the marketplace. Many of them are very affordable, which makes banking services accessible to everyone, including Canadians with low income.

The low-cost accounts are priced at $4 per month, but there are also discounted and free accounts for students, youth, and newcomers, which help boost consumer spending.

15. On average, a Canadian pays $200 per year in banking fees.

(Source: Yahoo!)

There are many advantages and benefits to online Canadian banking. One of them is having lower or no fees, which you won’t find in traditional banks. Another advantage is the convenience. Paying bills is easier, as is transferring money between accounts.

Unlike regular savings accounts, which have low-interest rates, some online banks offer high-interest rates on term deposits and savings.

Retail Banking in Canada

16. One in five Canadians say that they trust retail banking more than they used to.

(Source: BCG)

During the lockdown period, customers increased their digital banking. In turn, this contributed to customer sales to shift fast. Around 45% of customers are planning to buy new products, which is a sign of trust in retail banking.

17. The market capitalization of RBC was $132.52 billion in 2020.

(Source: Statista)

As per the Canadian banks’ ranking for 2020, the Royal Bank of Canada is the largest bank in the Great White North in terms of market capitalization. RBC was founded in 1864, and its head offices are in Toronto. It has 1,210 branches and 4,200 ATMs.

18. The Royal Bank of Canada had $1.62 trillion in assets in 2020.

(Source: Statista)

According to the latest Canadian banking statistics, RBC’s assets have skyrocketed in recent years. In 2014, the bank had $941 billion. It surpassed the $1 trillion mark the following year. The high number of assets that RBC has goes hand in hand with a large number of employees.

19. In 2020, the Royal Bank of Canada got 794 out of 1,000 points for customer satisfaction.

(Source: Statista)

In 2020, RBC got the highest satisfaction rate of all Canadian banks. Other banks that scored high as well were TD Canada Trust (790 points), CIBC (787 points), Bank of Montreal (784 points), and Scotiabank (782 points).

20. Toronto Dominion bank serves approximately 22 million customers and has over 85,000 employees.

(Source: LinkedIn & Statista)

TD bank was founded in 1855. The bank’s income and assets have both increased steadily from 2013 to 2020. In 2020, TD’s total assets amounted to $1.71 trillion, up from $1.41 trillion in 2019. So, TD surpassed RBC in terms of total assets for the first time, banking statistics reveal!

21. Scotiabank employs 90,000 individuals and serves 23 million customers in 55 countries.

(Source: Corporate Finance Institute)

Scotiabank was established back in 1832. The bank’s total income in 2016 was US$20.76 billion, while the bank’s assets were US$714.4 billion. Scotiabank is renowned for commercial and personal banking, corporate and investment banking, and wealth management.

22. The Bank of Montreal has 12 million customers and 43,360 employees.

(Source: BMO, & Macrotrends)

BMO’s total assets as of October 2020 amounted to US$706.155 billion, a 10.3% increase from 2019. Previous years’ figures were as follows – in 2019, US$641.192 billion, a 6.58% increase from 2018; in 2018, US$601.59 billion, a 10.97% increase from 2017.

Conclusion

Canadian banking standards are so high that they make the Canadian monetary system one of the leading in the world. As mentioned in the statistics above, Canadian banking revolves around the five major banks in Canada. They have some of the most valuable stocks in the country.

All banks are supervised under Canadian banking regulations. The Office of the Superintendent of Financial Institutions (OSFI) does prudential regulation and looks after financial stability, while the Financial Consumer Agency of Canada (FCAC) is responsible for market conduct and consumer protection.

Last but not least:

Clients have embraced the technological innovations Canadian banks offer. In fact, the latest banking stats show immense growth in the use of digital banking services and mobile app downloads. Studies expecting these numbers to grow further, even in the face of a potent challenge from Bitcoin and other cryptocurrencies.

FAQ

The banking system in Canada groups its financial institutions into five primary types. They are the chartered banks, the cooperative credit movement, security dealers, life insurance companies, and trust and loans companies. The chartered banks in Canada, also known as commercial banks, are authorised to accept deposits and extend loans for personal, commercial and other purposes.

There are 88 banks in Canada. They include 35 domestic banks, 4 foreign bank lending branches, 28 foreign bank branches, and 21 foreign bank subsidiaries. They provide around 18,303 automated banking machines across the country.

The largest bank in terms of assets is Toronto Dominion Bank ($1.71 trillion as of October 31, 2020), followed by the Royal Bank of Canada ($1.62 trillion as of October 31, 2020). However, RBC has the biggest market capitalization (132.52 billion in 2020). RBC and TD are part of the “Big Five,” along with the Bank of Nova Scotia, Bank of Montreal, and the Canadian Imperial Bank of Commerce. The total of these Canadian banks market share is around 85%.

The Royal Bank of Canada is the most popular bank in Canada, with a customer satisfaction rating of 794 out of 1,000 points in 2020. When it comes to popular Canadian banking, TD came second, with 790 out of 1,000.