What Is a Credit Memo in Canada?

Ever returned a product you bought in a store in Canada? Then you probably also received a credit memo upon completing your return.

But what exactly is a credit memo, and how is it different from a debit memo? This article will explain all there is to know.

Keep on reading to find out!

What Is a Credit Memo in Canada?

If you have ever returned an item purchased in a Canadian store, you might have received a credit memo on your bank statement. Both businesses and individuals get the bank credit memo on their account statements after a completed return.

Although customers might feel like a credit memo is just another word for a refund from the seller, it’s different.

Namely, when issuing a refund, a seller pays back the amount you paid for the items received. Keep in mind that the seller doesn’t refund shipping costs if there are any.

On the other hand, a bank credit memo is the paid amount refunded in the form of credit, which can be used for another purchase.

This is a common practice for small business owners and local retailers, whereas the big market chains and supply stores usually have a strict refund policy.

Read More: The Best Clothing Brand in Canada

What Information Does A Credit Memo Include?

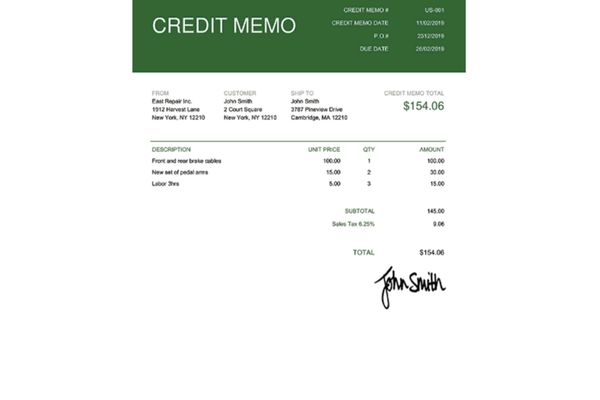

A credit memorandum from the bank is useful for businesses in terms of keeping track of their inventory, as it contains specific order information such as:

- Terms of payments

- Billing methods

- Shipping address

- Names of items

- Quantity of items

- Price of items

- Date of purchase

- Purchase order number (PO)

Here is an example to help you get a better understanding of what a bank credit memo looks like:

When Is A Credit Memo Issued?

Typically, a credit memo in Canada appears on a bank statement when a return is completed. However, there are other possible scenarios, such as:

- A damaged or defective product

- A clerical error

- An overpayment made by the customer

If you’re a business owner, here are some typical credit memo examples:

- Interest has been added because you have money in your account

- The bank collected a note for your business

- The bank provided a refund of a prior charge

Keep in mind that business owners who issue credits need to report them on their tax records. Using proper tax filing software in Canada can take this burden off your shoulders.

What Is a Debit Memo Charge?

Merchants issue debit memos to notify a customer of the current amount of debt obligations between them. The most common reason for this is undercharging, probably due to miscalculations on the side of the business owner.

Moreover, it’s a common practice for banks to notify their clients about the debts they owe to the bank.

Debit memos can result from bank service fees, bounced check costs, or additional checks that must be printed. The memos are generally sent out with the monthly bank statement to bank account holders and have a negative sign next to the charge.

That being said – eliminating these debit memos will help improve your current credit score.

However, a debit memo also notifies about a standard business-to-business transaction. It appears on the business’s bank statement supplied with certain goods or services before receiving an official invoice.

This is a common practice for ongoing business relations between trusted partners and customers, and it’s an official document to prove the debt, usually until unofficial compensation arrangements are completed.

When is a Debit Memo Charge Issued?

Typically, the debit memo charge is issued when a customer has been undercharged regarding a specific transaction or purchase of an item.

Nevertheless, an undercharge is not the only scenario when this charge may appear on your bank statement. Here are a few other common debit memo charge examples in Canada:

- Monthly loan payments

- Chequing account maintenance charges

- Reducing the amount for a customer’s cheque returned for insufficient funds

- Bank’s fee for the customer’s cheque returned for insufficient funds

Finally, debit memo charges should be reported by customers when filing for taxes. If your bank covers the debit memo charge, these tax charges are on you.

Read more: When Are Taxes Due in Canada?

Finishing Thoughts

So there you have it. Your complete guide to credit and debit memos in Canada – two financial documents that might appear on your bank statement in different situations.

Taking these benefits or current dues into consideration can help you calculate your debt consolidation more efficiently.

FAQ

A Memo is short for ‘memorandum,’ and in terms of banking accounts, it’s a statement of a current financial situation (a debt or a positive balance) between two sides in business relation or specific transaction.

Though they’re similar, a credit memo is not a refund, but rather an unused fund or shopping credit that can be spent in a specific store or business.

A credit memo is a notification you have unused funds at a certain store or business, usually due to a wrongful charge or return.

A debit memo is a notification of a current debt owed to the business issuing the debit memo document.

A successful return is the most common reason for receiving a credit memo in Canada. Still, other cases, such as wrongful charges that cost more than the regular price, are also possible.