Graphene Stocks and Companies You Should Invest In

The business world is booming with new investment opportunities every day. One of these current fads is graphene.

As new information about graphene stocks resurfaces, we’ve decided to bring you the most relevant details and keep you up to date on the trends. Additionally, we’ll tell you the top graphene companies in Canada. Let’s get into it!

What is graphene?

Before we dive headfirst into the intricacies of graphene investing, we should discuss what this material is.

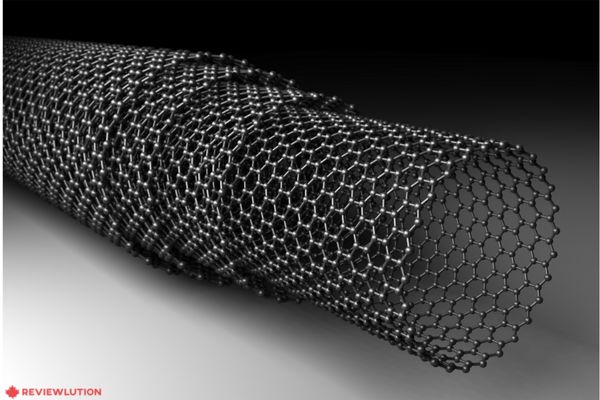

Graphene is the world’s most robust material (about 200 times stronger than steel). It’s also the thinnest material known to man, with only a single carbon atomic layer arranged in a honeycomb structure.

If you’re a savvy businessman looking to invest in graphene, check out our list of the best Canadian graphene companies to make an informed decision about where to put your money.

Read more: Stock Market Statistics

Best Graphite Mining Stocks in Canada at a Glance

Graphene Stocks in Canada

Canada is home to some of the best graphene companies in the world. Furthermore, these companies provide what are, in our opinion, the top graphene stocks out there.

NanoXplore

- Founded: 1995 in Montréal, Canada

- Gross revenue for 2021: 67.62 million

NanoXplore is one of the leading graphene companies in Canada. They produce high-quality and high-volume graphene powder for industrial use. Additionally, NanoXplore manufactures custom graphene-enhanced plastic for various industries like transportation, electronics, pipe, film, etc.

The company has a $10 million project with the Sustainable Development Technology Canada (SDTC) to replace metal with graphene-enhanced plastic, thus improving the resistance of materials.

At the time of writing (2022/02/09), NanoXplore’s stock value is currently $5.01. According to their financial statements, the company saw a market value growth of 24,94% in 2021. Their stocks don’t show any significant surges or dips but rather a gradual increase and decrease. The market cap is at approximately $798.76 million.

So, should you buy their shares?

We believe it’s a reasonable investment, given that the company has a prosperous future and cheap pricing. What’s more, their revenue is expected to double in the next few years!

Read more: Best Canadian Banks to Invest in

G6 Materials

- Founded: 2013 in Ronkonkoma, USA

- Gross revenue for 2021: 1.94 million

You can’t discuss publicly-traded graphene companies without mentioning G6 Materials. The firm was formerly known as Graphene 3D Lab but changed its name after a complete overhaul. G6’s facility focuses on developing high-performance graphene-enhanced materials. Their current objective is to apply graphene to the air purification market.

While writing this article, analysts gauged the company’s stock value at $0.08. This number has come about after a significant decrease in market value (63,64%) since March 2021. The dip is likely due to inflation and the remnants of the COVID-19 pandemic. Consequently, G6 Materials’ market cap is approximately $13.19 million.

Since our economy sees constant fluctuations, the cheap shares G6 offers should be snatched up as soon as possible. Furthermore, their stocks could be a profitable investment in the long run, as a long-term increase in value is expected, and the stocks offer good returns.

Northern Graphite

- Founded: 2002 in Toronto, Canada

- Gross revenue for 2021: N/A

Northern Graphite is among the most prominent Canadian graphite companies. Currently, the firm is developing a graphite deposit in Bisset Creek to upgrade mine concentrates for graphene, lithium-ion batteries, electric vehicles, fuel cells, and other advanced technologies. By extension, it is expected that this project will have the highest margin of any graphite deposit.

Northern Graphite’s stocks are at $0.79 at the time of writing. Recently, interest rates have been witnessing significant surges with growths of 21,54%, from a market value of $0.37 in September 2021. Additionally, the market cap is approximately $64.76 million, showing that the company is still doing well.

If you’re considering investing in graphene manufacturers, Northern Graphite proves to be a safe bet, as their stocks offer good returns. Moreover, since this firm’s shares are steadily rising, buying them looks like a profitable investment option in the long run.

NextSource Materials Inc.

- Founded: 2004 in Toronto, Canada

- Gross revenue for 2021: N/A

Similar to Northern Graphite, NextSource Materials is a mine development company currently sourcing its graphite from the Molo mine in Madagascar. The project is adequately named the Molo Graphite Project and is in the feasibility stage.

Interestingly, NextSource Materials’ stocks were $4.04 while writing this article (2022/02/09). However, this isn’t even their highest pricing, as February of 2021 saw a high of $4.80! The company’s market value shows fluctuations throughout the year, with a low of $1.91 in September of 2021 and a growth of 45,00%. Nevertheless, NextSource’s market cap is going steady at $396.01 million.

But are their shares worth it?

This company’s graphite mining stocks are an attractive opportunity for investors. Amazingly, the firm’s revenue is forecast to grow by 65.99% per year, and analysts contend investors should buy shares now and get in on the approaching success.

Read more: Next Cryptos to Explode in 2022

Gratomic

- Founded: 2007 in Toronto, Canada

- Gross revenue for 2021: N/A

Gratomic is one of the most famous graphene companies in Canada. This forward-thinking firm focuses on excavating natural graphite in desirable jurisdictions that support its infrastructure. Therefore, they’re currently working on a flagship AUKAM project in Namibia and another one in Quebec.

Gratomic’s stock values boast an attractive price of $1.31 at the time of writing. Coupled with overall general stability in market value during the fiscal year of 2021, the company is currently on top of the game. The lowest stock price recorded in 2021 was $0.85 in February, while the highest was $1.76 a month later, in March. Furthermore, Gratomic’s market cap is at $240.87 million.

Gratomic’s stock received an A+ from analysts as an excellent long-term investment option. Based on forecasts, stock prices will reach $5.95 in approximately five years, with revenue at around +354.53%.

Saint Jean Carbon

- Founded: 1997 in Calgary, Canada

- Gross revenue for 2021: $37,57k

Saint Jean Carbon is a company that continues to transition and advance in the carbon sciences and battery technology industries. Many investors consider it a pillar of Canadian graphene companies because of its sustainable developments and competitive advantage.

Saint Jean Carbon’s stock value on 2022/02/09 is $0.14. Since June of 2021, the company has witnessed a steady trend, with market values ranging from $0.24 to $0.11 and no significant surges or dips. The market cap has been going steady at approximately $18.05 million. The company has seen some growth of around 27,27% in 2021.

So, should you invest?

With a price of $0.14, who could resist? Saint Jean Carbon’s stock prices have shown rising tendencies and general stability. Therefore, it’s not unusual to conclude that such trends will continue in the foreseeable future. Why not take the leap of faith?

Graphene Manufacturing Group

- Founded: 2016 in Richland, Australia

- Gross revenue for 2021: $1.04 million

Another prominent graphene manufacturer is the fittingly named Graphene Manufacturing Group. GMG currently produces graphene powder from low-cost feedstock. What’s more, they have developed a proprietary production process to manufacture high-quality but inexpensive graphene. Now, they are involved in energy saving and energy storage solutions.

Unsurprisingly, GMG’s stock value is $4.35 as of February 9th, 2022. Since October of 2021, the company’s market value has witnessed a dramatic growth of a whopping 312,31%! In November, the stocks cost $6.47, which was simultaneously their highest price of the year. Additionally, the market cap is $324.366 million. We have to say – those numbers are impressive.

So what’s our verdict? From what we’ve gathered from official financial statements, it’s clear the company is rapidly growing. According to analysts, these trends will continue in the coming years, meaning GMG’s shares will give investors more bounce for the ounce.

Cabot Corporation

- Founded: 1882 in Boston, USA

- Gross revenue for 2021: $3.40 billion

Cabot Corporation is last on our list (but certainly not least!). As the oldest firm mentioned, Cabot Corporation has become a leading global specialty chemicals and performance materials company. They are specialized and committed to advancing businesses in various industries, including infrastructure, transportation, and environment.

With share prices of $69.51 at the time of writing, Cabot Corporation currently offers the top graphene stocks. In 2021, the company saw some steady increases and decreases, with a low of $48.11 in September 2021. However, their stock values have been skyrocketing since January 2022. The company’s market cap is expectedly high, standing at $3.92 billion.

As the most expensive stock on our list, Cabot gives its competitors a run for their money. Moreover, analysts are adamant that these shares are an exceptional investment opportunity, with considerably good returns, as earnings are forecast to grow 43,5% per year. Without a doubt, Cabot Corporation should be a serious contender for your next investment.

Finishing Thoughts

We hope you’ve gained some valuable insights about graphene stocks and companies.

Before you invest your hard-earned money into shares, make sure you do some thorough research to determine which company best aligns with your values and interests. And who knows, maybe you’ll be the next Warren Buffet!

FAQ

Graphene is made by specialized graphene companies in Canada and other parts of the world. Graphene is not yet a mainstream material, but it’s got a bright future.