How to Read a Cheque? A Complete Breakdown

If you’re a beginner and want a better understanding of how cheques work, you’ve come to the right place.

This article will provide you with valuable information on how to read a cheque and correctly interpret each part, and by doing so, you will be one step closer to writing a cheque yourself.

Keep on reading to learn more!

What Are the Parts of a Cheque?

Reading checks might seem confusing at first glance as they don’t come with instructions. But it’s essential to learn to read the check details and correctly translate the different parts. Let’s find out what each part of a Canadian cheque represents!

Personal Information

You’ll find this section in the top left corner. It contains information about the authorized account user who issues the cheque.

On the top line, you’ll need to write your full name as stated on your bank account. Next, the second line requires your home street address, while the bottom line is reserved for the city, province and postal code.

If you have a personalised cheque, this information will already be filled in. On the other hand, starter and temporary cheques oblige the user to write the check info.

Payee Line

Next, we have one of the crucial check lines. The payee line contains the name of the individual, business, or organizations receiving the payment.

Keep in mind that you need to use an individual’s legal name when filling out a check, as some banks have strict policies that don’t allow spelling mistakes or nicknames.

Analogically, cheques issued to businesses require the business’s legal name instead of its DBA name.

Lastly, make sure you use comprehensible writing in this section of a cheque.

Dollar Amount Line

After determining the recipient of the cheque, you’ll need to write the amount you wish to pay on the dollar amount line.

Here, users are required to enter the exact sum in words. This prevents potential misreading of the figure given in numbers in the dollar amount box. Additionally, you can avoid a thief trying to alter the numbers on the cheque.

Dollar Amount Box

Right next to the dollar amount line, you’ll notice the dollar amount box. All you have to do here is enter the total amount in numbers.

Don’t forget to include any cents that need to be paid. If there are none, simply write an even number or enter a decimal followed by two zeros.

Memo Line

While the memo line isn’t among the mandatory check details, it serves as a reminder of the reason behind the payment.

Filling in the memo line is beneficial as it enables you to keep a record of all of your payments and see what you have spent your money on.

Date Line

The date is supposed to be written on the top right corner of the cheque, including the year, month and day.

On a Canadian cheque, the date should be in the following format: DD.MM.YY.

The date represents the day that the check was written and it’s valid for six months.

Signature Line

You’ll notice the signature line on the bottom right corner of the cheque.

When filling out a check, the endorser must use the same signature used when opening the checking account at their bank.

If the signature is missing or it is incorrect, then the cheque will be considered invalid.

Bank Name

The bank name and address are usually printed on the cheque itself and they represent the bank of the account’s holder.

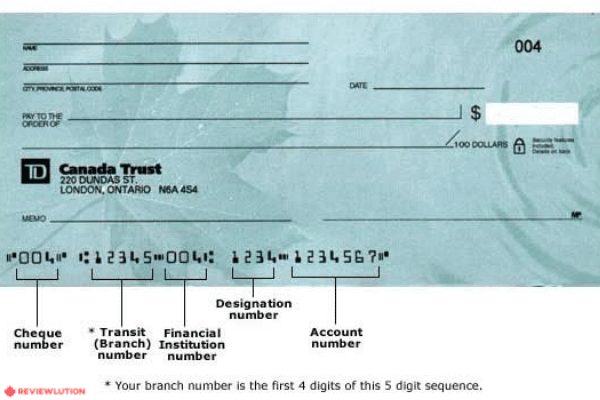

Routing Number

The routing number on a check is an 8-digit number that consists of the transit number and the institution code.

The transit number has five digits and stands for the home branch of the bank, while the institution code consists of three digits and refers to the bank or financial institution’s code.

In simple terms, the routing number is a bank identification number. Each bank has its own routing number that is unique only to them.

Account Number

Many people are confused about the routing vs account number and wonder what is what on a check.

On a Canadian cheque, the account number is the last one on the MICR encoding line and it’s between 7-12 digits long. Some banks might use dashes and spaces between numbers, while some use a format with no spaces in between.

Although it is your bank that decides the format and number arrangement, the MICR design is always the same for all Canadian banks.

Cheque Number

On Canadian cheques, the cheque number is at the top right corner and is the first number of the MICR line at the bottom of the cheque. The check account number is usually a 3-digit or a 6-digit number used for tracking. It helps users identify which checks have been used from the chequebook.

Fractional Bank Number

The fractional number on a cheque is an abbreviated form of the routing number and it’s used to determine the location of the original bank within the banking system.

Now you have a comprehensive breakdown of all 12 parts of a cheque to help you understand them better.

When to Use a Cheque?

While there has been a decline in the usage of paper cheques across the world, they are still widely used as a valuable method of payment. There are several instances where using cheques could be the best way to pay for something or to make a money transfer.

For example, you can use checks to pay small businesses, make bill payments, deposit and move funds between accounts, and make a down payment on a house or car.

Additionally, you can also pay someone for a service. Whether it’s only a one-time or it’s occasional work like a dog walker or if someone is mowing your loan, using a cheque is a convenient way of payment.

Another factor to consider is that many elders in Canada don’t have an access to the internet or don’t know how to make an online payment. So, filling out a check could really come in clutch.

Unlike cash, paper cheques are still considered to be a valid method of payment that can provide a level of safety in your transactions and money transfer. Many businesses still prefer to pay individuals by using paper cheques which are a great way to pay if the employer does not offer direct deposit, or if you are working as a freelancer.

What Are the Benefits and Drawbacks of Cheques?

The value of using cheques is undeniable for sure, but let’s see what are the positive and negative sides of these once so-popular paper slips.

Benefits of a Cheque

- They’re a great option for bill payments.

- They can easily be traced in the event of a loss or theft.

- Payments can be terminated if the check is lost or stolen.

- They serve as proof of a complete payment.

- All cheques are entered into the bank’s computer system.

- If you get paid by checks, you don’t need a bank account to cash them.

- They enable you to keep a record of all of your spending.

- Carrying a chequebook instead of cash is much safer.

- You can make small business payments.

- You pay a large lump sum without using cash.

- Checks can be gifted.

- You can write a cheque to yourself to either pay yourself or move funds between your bank accounts.

- Cheques are a great option if there is no internet access.

Drawbacks of a Cheque

- Cheque payments aren’t accepted everywhere.

- If you’re in a hurry to make payments or make money transfers, cheques can take longer to be processed than an electronic transaction.

- If you don’t have enough funds in your bank account but still want to write a cheque, then your cheque will bounce and you might be charged fees.

- Depositing a cheque requires physical presence in a bank.

- Cheques expire after six months.

- You’re at risk of cheque fraud.

Ultimately, cheques will remain irreplaceable for some people. For others, the usage of digital tools for payments and money movement will always be the best solution.

What Is the MICR Encoding Line?

After covering all the check details and check numbers, we have left yet to explain the MICR encoding line.

A MICR line on a cheque is located at the bottom of the cheque and is an acronym for Magnetic Image Character Recognition. The MICR Encoding line is printed using magnetic ink and it includes the account and routing number on a check, as well as the check account number.

The MICR line contains valuable check information. This info is being identified and read by special processing machines and scanners. During the scanning process, the numbers are instantly converted into digital data, which is then used by the banks in order to process the Canadian cheques and complete the payments.

Finishing Thoughts

Reading a check is easy once you understand what the check lines mean. It can be daunting at first, but it’s useful to know how to write and read it because it is still a widely acceptable form of payment across Canada and you never know when you might need to use a cheque.

FAQ

Writing in cursive on a cheque is not mandatory. However, lines written in words should be clear.

Although a written check is valid only six months, chequebooks do not expire.

Depending on the quantity and style of the cheques, the average cost of a chequebook in Canada can range between $25 and $70.

The check number represents the reference number on a check and it usually consists of three digits, although, recently many Canadian banks have started to require as many as six digits in a check number.

Once you learn how to read a check, you’ll know that In Canada, the routing number is a total of 8 digits. It consists of a five-digit transit number and a three-digit institution code.