How to Save Money as a Student in Canada?

Are you a fellow student in Canada looking for ways to save up some money?

We’ve got you covered. Here are 10 tips on how to save money as a student.

Keep reading!

How to Save Money as a Student in Canada?

Despite studying in Canada being significantly more affordable compared to other countries, it’s still pretty steep and saving up on unnecessary things will definitely do you good.

So, how to save money in college?

Let’s get right into it.

1. Shared Living Space

A solid money saving plan has to include finding a shared living space. This can be with a friend, family member, or another student. You can also look into sharing a house or an apartment with other people. This will help you to significantly reduce your living expenses.

Apart from that, you may also split your utility expenses and the cost of any shared furnishings, saving you even more money every month.

2. Student Discounts

Student discounts are among the best tips you could get on saving money. You can get discounts on everything from food to clothing to entertainment. Be sure to ask about discounts at stores, restaurants, and movie theatres. You can find Canadian student discounts online by looking them up online.

3. Second-Hand Materials

One of the hidden costs of being a student is the number of textbooks you’re required to buy at the beginning of each semester. Naturally, one of the best money saving hacks for a student in Canada is to buy your books and other university materials second-hand.

To save even more money, you can also do this with clothes, furniture, and other materials you may need. Buying second-hand is a great way to save money, and you can often find what you need online or at local thrift stores.

The best thing is that when you’re done using them, you can always resell them.

Read more: Frugal Living in Canada

4. Side Jobs

Taking on an additional job or two alongside your studies is one of the most realistic ways to save money while in college. Although studying may consume the majority of your time, you may probably afford to spend 15–20 hours each week working a few extra dollars on the side.

Let’s take a look at some common examples of student jobs.

Sell Your Lecture Notes

Students who weren’t particularly attentive in class at the end of the term are usually found wanting lecture notes. This gives you the chance to supplement your income by selling your lecture notes directly to them or via educational platforms.

Work as a Virtual Assistant

Virtual assistants work remotely for clients all around the world, assisting them in managing their daily activities. That may be a lot of work, and it’s certainly not as exciting as working in an office. However, the flexibility that comes with freelancing allows you to balance your finances and spend quality time studying, making it the best way to save money fast.

Become a Brand Ambassador

If you decide to work as a brand ambassador for your university, you’ll be a go-to person on campus for students looking for information about the university and the programs it offers.

This is a nice way to earn something on the side while still being engaged with your university and building a solid student portfolio.

If finding a job is not a possibility at the moment, you could try supplementing your income through various investment vehicles. For instance, domestic and foreign students can earn interest on their GIC investments which can help cover most of the monthly living expenses in the country.

Check out some other fast-money jobs in Canada!

5. Save on Utility Bills

As a student, other good ways to save money include becoming conscious of how much energy your household wastes each month allows you to start making significant savings as soon as possible.

This might imply lowering your thermostat, ensuring that no gadgets are left on standby, comparing energy and water providers for a better deal, and replacing any particularly inefficient appliances.

If you live with other people, it’s nice to make this a habit so that all of you could pay lower utility bills.

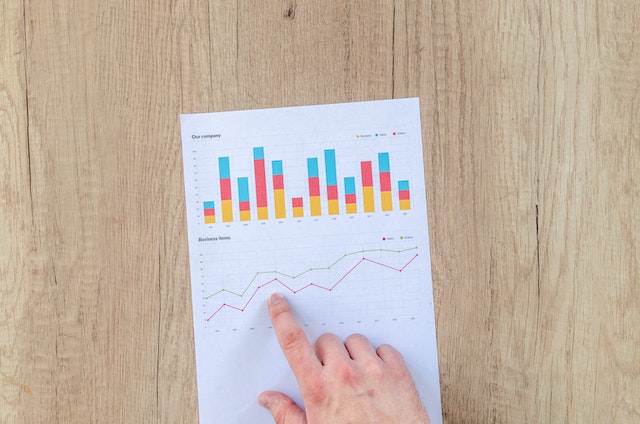

6. Budget

Learning how to budget is one of the most effective methods to save money while in college.

So, how to budget as a student?

You could start by keeping track of your expenses but you also need to have a thorough understanding of your monthly income streams and expenditures. This way, you can optimize your spending in a way that enables you to save money.

7. Purchase Intentionally

When it comes to simple ways to save money while in college, less is more. Plus, adopting a minimalist mentality may help you save money. Simply said, to lead a minimal lifestyle entails having fewer possessions. You only acquire items that are truly required, and you aren’t lured into the traps of a materialistic culture that tries to persuade you that you need more things in order to be happy.

8. Eat out Less Frequently

While buying ready-made meals may seem to be a convenient alternative, you’ll pay substantially more than cooking your own food at home. Restaurant and takeaway restaurants have a large markup on food sold.

The funds saved on a single meal, for example, may be used to purchase the components for around five burgers at home.

Plus, isn’t it time to boost your cooking skills?

9. Plan Your Meals a Week Ahead

Planning your meals ahead of time allows you to get an idea of how much your items will cost, making it easier not to go over budget while shopping. It also implies that all the things you buy are going to be used which is why it’s considered one of the fastest ways of saving money.

If you calculate how much money you’re throwing away by throwing food, you’ll realize what meal planning can do you in terms of savings.

10. Don’t Shop on an Empty Stomach

It’s easy to spend more on food if you’re hungry. If you let your stomach determine what goes in your shopping cart, you’ll buy needless ready-to-eat goodies as you walk down the aisles, which will significantly raise your overall grocery budget.

So make supper before going food shopping!

Wrapping it all up

So there you have it, a bunch of advice on how to save money as a student in Canada. We hope our ideas suit you and that you manage to efficiently save money during your studies.