12 Scary Identity Theft Canada Statistics

Table of Contents

Even though the term “identity theft” was coined relatively recently, in 1964, fraudulent use of people’s personal info has existed for ages. Identity theft occurs for a variety of reasons – some people simply need a fake identity, others seek financial gain. Yet, others want to assume the identity of influential or famous persons.

Today, we’ll focus on identity theft Canada statistics and see how the Great White North deals with this problem.

The thing is:

Whatever the motive, identity theft is always a huge burden for society. However, it’s very challenging to accurately estimate the financial toll of identity theft because most cases go unnoticed for a long time.

Moreover, there are many types of ID fraud and theft, including:

✔️Financial identity theft

✔️Criminal identity theft (using someone’s identity to hide from the police)

✔️Medical identity theft

✔️Child identity theft

Would you like to find out more? Here’s a sneak peek.

Incredible Identity Theft Statistics (Editor’s Choice)

- Around 49 million US residents experienced some form of ID theft in 2020.

- 6% of EU residents experienced identity theft between 2016 and 2019.

- In Canada, there are 12 victims of ID theft per 100,000 residents and 52 victims of ID fraud.

- Identity theft became a crime in Canada in 1998.

- Around 21,000 Canadians have been victims of COVID-19 related fraud, a significant proportion of which included identity theft.

- ID theft in Canada can be punished by five years of incarceration.

- Digital identity theft attempts are on the rise, marking a 218% increase since the start of the COVID-19 pandemic.

Global Identity Theft Facts

1. Around 49 million individuals in the US have fell victim to ID theft and fraud in 2020.

(Source: CNBC)

The United States is the country with the most reliable and up-to-date info on identity theft.

And the data is quite scary:

$US56 billion is the financial damage inflicted by scammers in the US in 2020 alone. And $US43 billion damage was caused solely by scammers who contact their victims directly. On average, each US victim of identity theft in 2020 lost around US$1,100.

2. 6% of EU residents experienced at least one incident related to identity theft between 2016 and 2019.

(Source: Statista)

More specifically, 3% of European Union residents experienced one incident linked to identity theft, and 2% suffered two or three incidents. Finally, there are the 1% of unlucky EU residents who have fallen victim to ID theft more than three times.

3. Identity theft stats reveal people in South East Asia are generally worried about ID theft, believing it is a real threat.

(Source: PrePrints)

According to an analysis by researchers from Bangladesh, 44% of Chinese citizens are worried about falling victim to scammers aiming to steal their identities. This is also true for 65% of Indians, 57% of Malaysians, and 63% of Singaporeans.

Identity Theft in Canada

4. ID theft cases are on the rise in Canada, with 12.46 incidents per 100,000 residents, according to 2019 identity theft statistics.

(Source: Statista; NBC.ca)

When we compared this figure to identity theft Canada cases per 100,000 residents in 2010, which stood at 2.3, we can see that ID theft cases have increased six times in the span of a decade.

What’s worse:

This trend is likely to continue as technology is becoming more and more implemented in all spheres of life. And we all know just how easy it is to access someone’s info once they enter the virtual world.

More specifically, there were around 17,000 Canadian victims of ID theft in 2012. By 2014, this number had increased to 20,000, indicating a massive 20% increase in just two years.

5. The financial toll of identity dropped from $16 million in 2012 to $10 million in 2014.

(Source: NBC.ca)

It might come as a surprise that the financial losses decreased while the total cases of identity fraud in Canada increased. However, there are many ways to explain this peculiar phenomenon.

Here’s the scoop:

As we pointed out earlier, there are many types of ID fraud and theft, and not all are equally sinister and damaging. So, it’s likely that the type of ID fraud crimes changed in Canada between 2012 and 2014. It’s also possible that the police learned how to deal with fraudsters and were able to reduce the damage in spite of the increasing incidence of this type of crime.

Further reading: Cyber Crime Statistics

6. ID fraud stats from Quebec show that there could have been as many as 338,000 cases of fraud and 240,000 victims in the province in 2006-2007.

(Source: NBC.ca, IPC.on.ca)

This particular 2008 survey of identity theft in Quebec, which included 1,100 residents, points to a worrying trend. According to the Quebec Ministry of Public Security, 40% of all ID fraud cases relate to card cloning, which is incidentally one of the most financially worrisome forms of ID theft.

What’s more:

Estimates of the Canadian Identity Theft Support Centre show that in 2008 there were around 2.25 Canadian victims of this type of crime (9.1% of the population), with $7.2 billion lost.

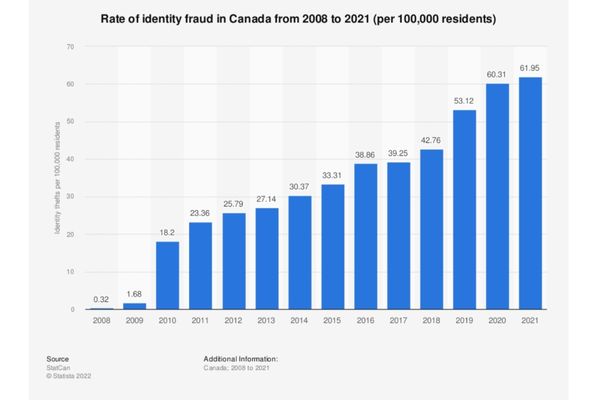

7. 2019 fraud statistics for Canada show that there were 52 victims per 100,000 citizens.

(Source: Statista)

Interestingly enough, the rates of ID fraud are much higher compared to Canada identity theft stats. We would expect an inverse relationship because identity theft is a necessary prerequisite of identity fraud. What’s remarkable is a steep rise between 2009 (1.6 victims of ID fraud per 100,000 residents) and 2010 (18.2 victims per 100,000 residents).

8. Identity theft Canada statistics from 2020 show that COVID-19 is often used as a pretext.

(Source: Canadian Anti Fraud Centre)

According to the Canadian Anti-Fraud Centre, 21,923 Canadians have fallen victim to COVID-19 related fraud, many of whom also suffered a theft of personal info. COVID-19 related scams and fraud resulted in a whopping $7.6 million worth of financial damage.

9. Medical identity theft in Canada is still a relatively unknown issue, as only 11% of the population is aware that fraudsters can alter medical records.

(Source: Newswire.ca)

More specifically, 11% of participants are familiar with the following scenario:

Fraudsters stealing medical records in order to alter them (add medical conditions) and take the money that would go for treating these imaginary medical conditions.

10. The identity theft in Canada punishment is pretty severe – five years of incarceration.

(Source: CriminalNotebook.ca)

Five years is the maximum sentence for indictable dispositions, while the maximum sentence for summary dispositions is two years in jail and/or a $5,000 fine.

Now:

Knowing the efficiency of the Canadian judicial system and the whole apparatus, we’re pretty sure that these sentences are indeed given in the appropriate situations. The Criminal Code recognizes various scenarios:

- Forged documents (passports, etc.)

- Fraudulent use of citizenship

- Perjury

- Theft or forgery of credit cards

- False pretence or statement

The Privacy Act and the Personal Information Protection and Electronic Documents Act are pretty clear when it comes to what kind of use of personal info is allowed.

11. Digital ID fraud attempts have risen by 218% since the outbreak of the COVID-19 pandemic.

(Source: Transunion.ca)

Credit card fraud statistics for Canada also show that there have been more attempts at this type of crime since the start of the pandemic.

This is not surprising:

A survey has shown that 60% of Canadians mostly use mobile apps for conducting payments, a trend that has asserted itself globally since the beginning of the pandemic.

12. With identity theft coverage of up to $40,000, Aviva is possibly the best choice for identity theft insurance in Canada.

(Source: Aviva, The Co-operators)

This will perhaps be enough for most victims of ID fraud and theft. As we saw earlier, on average, victims of this type of crime don’t lose too much money – nowhere near $40,000. The Co-operators offer coverage of up to 10,000$, which is also pretty decent.

In Conclusion

It’s safe to conclude that Canada is a fertile ground for ID thieves and fraudsters. Canadians love to use digital financial services and tend to be well off financially. These factors combine to make the Great White North an alluring destination for ID thieves.

Fortunately, the Government of Canada identity theft institutions and services are fast to inform the population about the newest scams. Additionally, there are many ways a victim can report an ID theft crime.

As we’ve seen, there are many victims of identity theft in Canada. But chances are that most identity theft Canada statistics underestimate the actual impact of this type of crime. Hopefully, better digital education and better government policies will combine to reduce the impact and extent of this prevalent issue.

FAQ

In the US, the country with the most detailed stats on identity theft, the most common type of ID theft relates to government benefits. Many criminals try to impersonate people in order to apply for government benefits. Then comes credit card fraud, business fraud, and tax fraud.

Identity theft became a crome in Canada in 1998, when the Identity Theft and Assumption Deterrence Act was passed. However, most identity theft Canada statistics come after 2008.

Around 4,500 Canadians get their identity stolen each year, according to recent identity theft Canada statistics. However, this is a conservative estimation, and the number of victims is probably much higher. A different source points to a 19,000 ID theft victim count in Canada.