How to Do a No Spend Month Challenge + Printable Template

If you need to tighten your belt and get your finances in order, you may be interested in doing a no spend month challenge! In this post, we’ll outline what a month challenge is and give tips on how to make it successful. Additionally, we’ll provide a no spend month challenge printable template for you. Read on!

What is a No-Spend Challenge?

A no-spend challenge is where you set a date range, usually a month, and pledge not to spend any money except on absolute essentials. This could be anything from groceries to bills, but it should not include spending money on fun activities or things you enjoy.

The point of a no-spend challenge is to see how much money you can save by reigning in your spending habits. It can be a great way to get out of debt or save for a specific goal. But it’s also important to remember that it’s not about depriving yourself, so if there are some things you really need during your challenge, go ahead and budget for them. Just make sure that everything else is cut out.

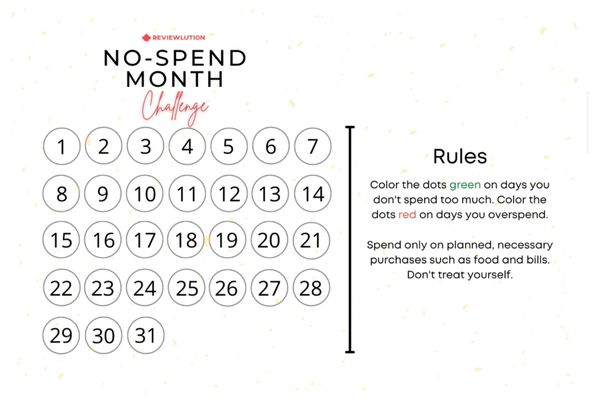

You can download this no spend month challenge printable template tailored to help you better succeed with this goal.

How to do a No Spend Month Challenge?

It can be tough to save money, especially when it feels like there’s always something new that we want or need. But living within our means is crucial to financial stability and security. One way to get a grip on our spending is to commit to a “no spending” challenge.

Below we’ll discuss some no spend month rules and tips on getting with this challenge more efficiently and successfully. Keep on reading!

Determine Your Financial Goals

The first step is to figure out why you want to do a no spend month challenge. Do you want to save up for a specific purchase? Or do you simply want to get your finances in order? Once you know your goals, you’ll be able to better stick to your challenge.

Determine the Length of Your Spending Freeze

When it comes to the spending challenge, it can last from a week, a month or even a no-spend year. Before starting a challenge like this, it is crucial to determine the length of your spending freeze. So, you must decide what timeline will work best for you and your goals. We suggest you begin with a no spend and no buy challenge for 30 days.

Decide if You Want Cheat Days

Saving money and cutting your expenses can be a tricky and demanding challenge. So, during a no spend month, you may want to allow yourself a few cheat days where you can spend money. This can help you stick to your challenge and avoid feeling too deprived.

Determine What You’ll be Allowed to Spend on

During a no spend month, you may still need to spend money on essentials like groceries, transportation, and utilities. Decide what expenses you’ll allow yourself and make a budget for those items.

Planning and preparation are key to success with a no spend month challenge. By setting goals and creating a budget, you’ll be more likely to stick to your challenge and achieve your financial goals.

We strongly advise using the printable spending tracker in order to have better control of your essential spending. Below are our suggestions of things you should be allowed to spend your money on during the challenge.

- Bills: You’ll still need to pay your regular bills, so make sure you have enough money set aside for that.

- Rent: If you’re renting, you’ll need to continue paying your rent.

- Food: You’ll need to budget for food for yourself and any family members participating in the challenge with you.

- Mortgage: If you have a mortgage, you’ll need to continue making your regular payments.

- Insurance: You’ll need to keep up with your insurance payments.

- Medicine: If you take medication regularly, you’ll need to ensure you have enough money set aside for that.

- Gas: If you have a car, you’ll need to budget for gas money.

- Transportation costs: If you use public transportation, you’ll also need to budget for that.

There may be other expenses that you’ll need to consider, so it’s essential to sit down and think about all the things you spend money on regularly before starting a no spend challenge. Once you know what you’ll need to budget for, you can start planning out your challenge.

What Are You Banning?

However, the most crucial part of the challenge is what you are banning. Usually, when saving money, people think that no shopping challenge is enough, but there is plenty of unnecessary spending that can be cut off.

Restricting the following thing will surely make your no-spend tracker look better.

- Restaurant meals: challenge yourself to cook more meals at home and eat out less. This will help you save money and eat healthier. Another way is to buy cheap foods instead of eating in fancy restaurants.

- Salon services: take a break from the salon and pamper yourself at home. You can find many do-it-yourself tutorials online for hair, nails, and makeup.

- Streaming services: instead of paying for streaming services, try renting movies from Redbox or watching shows that are available for free on TV.

- Clothing: one way to save money is to shop less frequently and only buy clothes when you need them. Try not to impulse buy clothes just because they are on sale.

- Gifts: during the holidays, instead of buying gifts, try making them yourself or giving experiences like tickets to a show or a gift certificate for a day of pampering.

- Alcohol: if you find that you spend a lot of money on alcohol, try cutting back or quitting altogether during your no spend month challenge. This will help you save money and improve your health.

Of course, there are more things you could ban during your challenge, but it could be personal-related spending, so you should realize it on your own.

But, what to do when you have no money? Keep in mind that plenty of things you could do for fun don’t require spending money. Some ideas include a picnic, home crafts, game night, biking, and reading.

Tips for a Successful No-Spend Challenge

There are a lot of tips for an easier and more successful no-spend challenge. For example, you could do the penny-a-day challenge. It will help you get organized and follow your goal and, at the same time, will help you save money.

Here are some more tips for a successful no-spend month:

Learn How to Distinguish Wants and Needs

If you’re considering embarking on a no-spend challenge, there’s one crucial tip to remember: learn to distinguish between your wants and needs.

It can be easy to fall into the trap of thinking that we need something when we simply want it. This is where a no-spend challenge can come in handy. By forcing yourself to go without spending any money for a set period of time, you’ll quickly learn what you can live without and what you truly need.

So, before you start your no-spend challenge, take some time to think about your wants and needs. This will help you stay on track and make the most of your challenge. Plus, do not forget about the no spend challenge printable template; it will surely help you easier succeed with your goal.

Avoid Rationalizations for Spending

It’s easy to rationalize our spending – even when we’re trying to save money. We convince ourselves that a purchase is a good deal when it’s actually not.

To avoid falling into this trap, be mindful of your spending triggers. Maybe there’s a particular store where you always spend more money than you intend to. Or perhaps you’re more likely to overspend when you’re bored or feeling down.

When you’re aware of your triggers, avoiding them is more manageable. And that means you’re less likely to rationalize your spending.

Stay Positive and Plan to Succeed

Saving money can be tricky, but staying positive and reminding yourself why you’re doing a no-spend challenge in the first place is essential.

It can also help to have a plan for success. Decide in advance how much money you want to save during your no-spend challenge, and make a budget to help you stay on track.

Get Back on the Wagon if You Fall off

If you do find yourself spending during your no-spend challenge, don’t beat yourself up about it. Everyone makes mistakes, and the important thing is to get back on track as soon as possible.

So don’t give up on your no-spend challenge just because you had a slip-up. Just pick yourself up and keep going – you can do it!

How to do a Spending Freeze with Kids?

If you’re looking to save money, one way to do it is to have a spending freeze. This means no unnecessary spending for a while, which can be difficult if you have kids. Here are some tips on how to do a spending freeze with kids:

- Be honest with them about why you’re doing it. Explain that you’re trying to save money and that this means not buying unnecessary things for a while.

- Get them onboard with the plan. Brainstorm ways to save money together and come up with fun activities that don’t cost anything (or very little).

- Keep them entertained with less expensive goods. There are plenty of ways to keep kids occupied without breaking the bank. Consider things like board games, puzzles, books, and homemade crafts.

If you’re looking to save money, a spending freeze is a great way to do it. Following these tips can successfully do a spending freeze with kids.

How to Stop Spending Money?

If you’re trying to save money, one of the best things you can do is stop spending money unnecessarily. Here are a few tips to help you cut back on your spending:

Sleep On It

If you’re considering making a purchase, wait a night or two before pulling the trigger. This will give you time to reconsider whether you really need or want the item.

Keep Tabs

By knowing where your money is going, you can identify areas where you may be able to cut back. A no spend month tracker will be of great use for this.

Calculate

When considering a purchase, think about how many hours you’ll need to work in order to afford it. This can help put the cost of an item into perspective.

Use Cash

When you use cash, you’re more aware of the money you’re spending. Credit cards can make it easy to spend without thinking about it.

Avoid Window Shopping

If you’re trying to save money, it’s best to avoid temptation altogether. Steer clear of stores or websites where you’re likely to be tempted to make an impulse purchase.

Finishing Thoughts

The idea of a no-spend month is simple – you get to decide how far you want it. If trying this challenge and not being able to have all your spending habits change, focus on what did happen for them to work better next time. Here’s the no spend tracker printable template once again, so it can help you during the challenge.

However, a no-spend month can help you save money or pay off debt, but it is not for everybody. You may decide that making more minor, more lasting budget cuts is preferable. Lucky saving!

FAQ

A straightforward way to start saving money is to make a budget and stick to it.

Figure out how much money you have each month and your fixed expenses, like rent or mortgage payments, car payments, insurance premiums, etc. Then figure out what you can afford to spend on variable monthly expenses, like groceries, utilities, gas and transportation costs, entertainment, etc.

Invest it! Money saved is money earned, and you can earn even more by investing it wisely. Choose a good investment advisor, develop a long-term investment plan, and stick with it. You’ll be glad you did!

One month is a perfect length of time for your first spending freeze. This will allow you to reassess your spending patterns and make necessary adjustments. Plus, it’s not so long that it will be overly difficult to stick to.

We strongly advise you to use a no spend month challenge printable template since it will help you to organize better and plan.