What Happens If You File Your Taxes Late in Canada?

Missed the tax deadline, eh? So now you’re wondering what happens if you file your taxes late in Canada?

Well, you won’t be let go scot-free, that’s for sure! But what exactly will you have to do, and is there a penalty for late tax filing? In this article, we’ll answer all the important questions, exploring the costs and when you might be able to get relief.

Strap in and let’s begin!

What Happens If You File Your Taxes Late in Canada?

The Canada Revenue Agency (CRA) considers late filing a serious issue. Therefore, the longer you go without filing, the more your charges will increase.

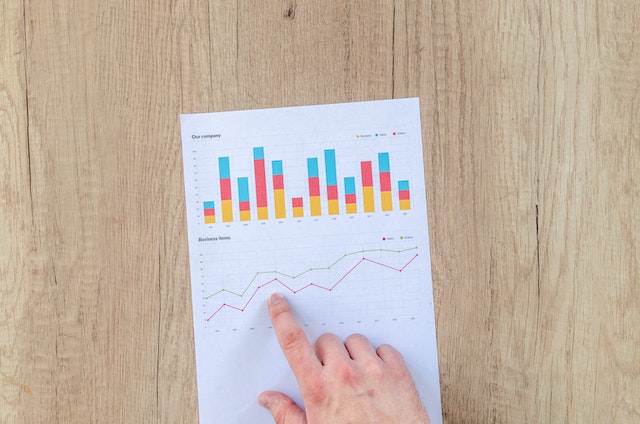

Since filing and paying your taxes is every Canadian resident’s duty, the CRA will have to fine you if you don’t file on time. Namely, you may incur a late-filing penalty and interest on any taxes you owe. Here’s a breakdown of the interest and late tax filing penalty in Canada:

Interest on Taxes You Owe

If you’re unable to pay your balance owing for the previous tax year by April 30th, the CRA will begin charging you compound interest from May 1. Consequently, this will include any balance owing, provided your tax return has been reassessed.

Unfortunately, we can’t tell you how much interest you’ll incur, as the prescribed interest rates change every three months.

You must remember the payment due dates if you need to pay tax instalments. If you forget and miss any, you’ll accrue an additional charge: instalment interest, which is compounded daily with the prescribed interest rates.

Penalties for Filing Taxes Late

If you file your tax return after April 30th and owe a balance, the CRA will charge you a penalty for late filing. But that won’t be your only problem! In fact, by filing late, you can also cause lengthy delays to your credit payments, assistance programs, and government benefits.

Currently, the CRA late-filing penalty for your 2021 balance owing is 5%. However, you’ll also have to pay an additional 1% for each full month after the due date, up to 12 months. The CRA will also withhold your refund until you file.

If you also have a late-filing penalty for any previous years and have received a formal demand for a return, your penalty will be 10% of your balance owing and an additional 2% for each full month after the due date, up to a maximum of 20 months.

Additionally, you may need to pay tax instalment penalties if your payments are late or you’ve spent less than the required amount. For 2022, the CRA adds an instalment penalty only if your interest charges are more than $1,000.

If you’re a small business owner or a self-employed individual, a failure to meet the payroll obligations set by the CRA will result in penalties for your payroll accounts.

Alternatively, if you’re an employer, filing information returns late can earn you a $10 penalty per day for less than 50 returns and much more if you have more employees. GST/HST will also add penalties for late filing.

You might be interested: How to Pay Less Taxes in Canada

Can You Cancel or Waive Interest or Penalties?

You’ll be relieved to know that the CRA penalties and interest can be cancelled or waived in certain events. Namely, if you’re unable to meet your tax obligations as a result of circumstances that are beyond your control, such as natural disasters, you can request a penalty cancellation or waiver.

Here are some situations that will warrant the Minister to grant you relief from penalty or interest on your income tax:

- Error on the part of the CRA such as processing delays, incorrect information provided, delays in providing information, undue delays for objections or appeals

- Financial hardship and an inability to pay if the interest charges take up a significant portion of the taxpayer’s funds or if payment would cause the taxpayer a prolonged failure to provide basic necessities

- Extraordinary circumstances such as disasters, civil disturbances, severe illness or accident, severe emotional or mental distress

To request Taxpayer Relief, you’ll need to fill in and submit form RC4288 Request for Taxpayer Relief – Cancel or Waive Penalties and Interest.

However, if you’ve deduced that you don’t meet the criteria, you can review the options available through the Taxpayer Relief Provisions.

Moreover, if you have unreported taxable income, overdue unfiled returns, or ineligible expenses, you can take advantage of the Voluntary Disclosures Program (VDP) to remedy past returns without incurring penalties. Therefore, if your tax return is older than a year, the VDP will give you a second chance by letting you pay your returns without punishment.

Related article: What Is the Effective Tax Rate in Canada?

Finishing Thoughts

As you can see, abiding by tax laws is the best way to avoid tax evasion. Even though the tax penalty for late filing might not seem like much, if you’re overdue on taxes for many years, you can be required to pay up to 50% of your balance owing to the CRA.

So if you’re able to pay on time, don’t wonder what happens if you file your taxes late in Canada and just submit that pesky tax return!

FAQ

According to the CRA, you have ten years from the end of a calendar year to file your income tax return. However, the longer you wait, the higher the penalties you will incur and the bigger the chance of being charged for tax evasion.

If you don’t owe taxes, the CRA won’t charge a late-filing penalty. However, you may experience a delay in receiving any returns.

Yes, if you file your taxes after the due date, you will incur late-filing penalties and interest on your balance owing, which is 5% of what you owe and an additional 1% for every full month after the due date.