![Neo Financial Reviews: Pros and Cons [Reviewed in 2024]](https://reviewlution.ca/wp-content/uploads/2022/07/20200408000532Neo_Financial_Logo.png)

- Monthly Fee: Neo CardTM: None; Neo CardTM (Secured): None;

- Number of Transactions : Unlimited

- Types of Accounts: TFSA, RRSP, Personal

- Customer Support: Phone, Virtual Assistant, Help Desk, Email

- Mobile App: Yes (iOS and Android)

Neo Financial Reviews: Pros and Cons [Reviewed in 2024]

If you’re looking for comprehensive Neo Financial reviews, look no further. This article will discover what this dynamic online banking company offers regarding financial products, features, customer service, security, and eligibility and application process.

Let’s dive in!

- Monthly Fee: Neo CardTM: None; Neo CardTM (Secured): None;

- Number of Transactions : Unlimited

- Types of Accounts: TFSA, RRSP, Personal

- Customer Support: Phone, Virtual Assistant, Help Desk, Email

- Mobile App: Yes (iOS and Android)

Best For

100% digital financial services

Strengths

- High cashback rates

- No monthly or annual fees

- Digital card available

- Competitive interest rates

- Low mortgage rates

- 10,000+ loyalty partners

Weaknesses

- Purchase APRs can be high

- Low cashback when shopping at non-partners

- Low credit limits

Overview

Neo Financial is a Canadian financial technology (FinTech) company founded in 2019 by not one but four brilliant minds: Andrew Chau, Chris Simair, Jeff Adamson, and Kris Read.

This Calgary-based company provides a wide range of financial products and services, such as

- Cashback credit cards,

- high-interest savings accounts,

- wealth management systems,

- and low-rate mortgages.

Furthermore, the Neo Financial team considers this online bank a multi-tool for money that aims to reshape the financial market for Canadians. The company has more than 750 accomplished employees and just under $300 million raised. And, by the look of things, the company’s ambitions have paid off accordingly, with a 4.8-star rating on Apple’s app store.

In brief, Neo Financial restructures how people save, spend, and earn rewards by helping users get the most out of their investments and partnering with some of the most coveted brands in the country. Another impressive Neo Financial achievement is the fact that this Canadian firm was able to reach 1 million customers and unicorn status in the span of just three years.

Let’s move further on and check out the products they offer.

Neo Financial Products

Neo Financial offers numerous products aimed at different financial goals, including credit cards, investing, saving, and mortgages.

Let’s check these offers one by one!

Neo Card™

Neo Financial offers credit cards with which users can get attractive cashback rewards. In fact, the Neo Card was voted Canada’s best cashback card in 2021, attesting to its appealing features.

Furthermore, if you opt for Neo’s cards, as their customers, you’ll enjoy the following perks:

- up to 15% cashback on first-time purchases

- an average of 5% unlimited cash back at 10,000+ partners

Moreover, besides the appealing cashback rewards, cardholders can also take advantage of a welcome bonus of up to 15% on first-time purchases, trumping other Mastercards that don’t offer any.

Additionally, Neo offers customers to choose their standard Neo Card or the Neo Card (Secured), depending on their needs.

Owning a Neo Card™ means you can enjoy the following additional benefits:

- Insights – Thanks to this feature, you can view your cashback rewards and purchases sorted into categories, receive instant spend notifications and alerts, and track your cashback.

- Split the bill – An upcoming feature that allows users to split payments in 4 instalments.

- Cash in on high interest – If you cash out your cashback to your NeoMoney™ account, you can enjoy a high interest rate of 2.25%

- Pay bills – With the auto-pay feature, you can automatically pay your Neo Card™ balance from your Neo Money™ account, or even pay other one-time or recurring bills.

To make your experience even more enjoyable, Neo allows you to combine your Neo Card™ with several different perk packages to boost your average rewards:

Travel perks – $4.99 per month, Valued at over $360 each year

- 2% cashback on every foreign transaction

- Priority Pass access to over 1,300 airport lounges

- SmartDelay airport lounge access at no cost in case a registered flight is delayed

- A boost of 1.5 for cashback earned at airline, hotel, and car rental travel partners

- Chubb travel insurance covering medical emergencies, trip cancellations, flight delays, as well as car rental protection

Everyday Essentials perks – $8.99 per month, Valued at over $170 each year

- 1.5x cashback boost on at grocery and wholesale retailers (including Costco and Walmart), liquor store and specialty food partners, and gas station partners

- Special offers at grocery store and gas station chains including Chevron, Husky, and Irving Oil

- Essential life insurance to pay off card balances + 24/7 legal assistance

Premium Access perks – $0.99 per month, Valued at over $100 each year

- Up to 20% cashback on first-time purchases

- Extended warranty

- Purchase protection

- Priority for customer support phone calls

- Special monthly cashback offers

- Access to early features

Mind and Body perks – $9.99 per month, Valued at over $430 each year

- 1.25x more cashback at fitness studios and gyms, in-store and online

- Unlimited access to premium music, meal plans, workouts, and more with a FitOn PRO subscription

- Headspace Plus subscription

Food and Drink Perks – $1.49per month, Valued at over $70 each year

- 1.25x more cashback at partner restaurants, diners, bars, cafes, as well as food delivery

Mobile & Personal Protection perks – $9.99 per month, Valued at over $420 each year

- Theft, breakdown, and damage protection for mobile devices

- Dashlane Premium subscription

- $1 million in coverage for fraud, ransomware, and social engineering

- 24/7 customer support and credit monitoring services

But that’s not all. To accompany your Neo Card™, you can set up a virtual card and enjoy the same benefits, even if you forget your physical card. Simply add your virtual card to your Google Pay or Apple wallet and enjoy features like:

- Freeze and unfreeze your card with just a tap

- Real-time transaction notifications

- Mastercard® Zero Liability protection

- Payment security

If you sign up for the Neo Card™ or Neo Card™ (Secured) through our website, you receive a $25 welcome bonus.

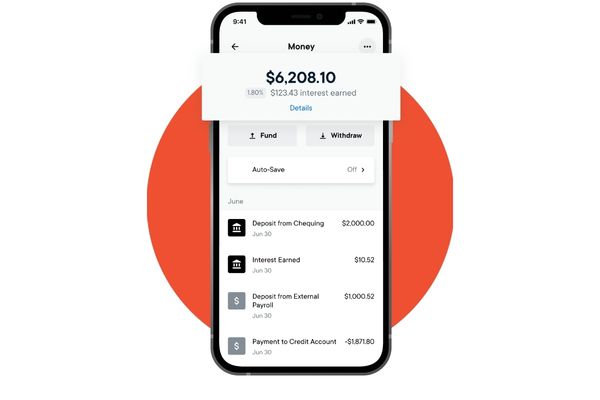

Neo Money™

This high-interest savings account product allows users to manage their savings, earn interest, and spend money directly from their devices. Moreover, with Neo Money, you can combine the advantages of a savings account with those of a credit card, simultaneously earning up to 225 times more interest than you would at a standard bank for no monthly/ yearly fees.

And, as if that’s not enough, the program also ensures you earn interest monthly, based on the day’s closing rate. This way, you can keep track of just how much money you earn over time through the Neo Financial app.

Additionally, Neo Money provides users with a platform to send and receive payments and deposit cheques for free (with no minimum deposit or balance).

That being said, here are three ways to deposit money in your account:

- Use Interac e-Transfer.

- Link any existing accounts, i.e., be able to move funds between accounts at any time.

- Establish a direct deposit. You can wire your paycheque to go straight to the Neo Money account and receive interest on it.

All of these methods are convenient and easy to use, so you can choose the one that best suits your needs.

What’s more, new users who open an account through our website will earn a $5 customer sign up bonus!

Neo Money™Card

Are you ready to take your finances to the next level? With the new Neo Money™ Card from Neo Financial, you can make payments online and in-store, getting instant cashback from exclusive partners in the rewards network. Plus, it’s super easy to use – no credit check required, so you’re simply spending money that’s already in your account!

Say goodbye to manual load funds and start using your Neo Money Card today for an enhanced online shopping experience. With zero fees and high interest savings with their accompanying Neo Money™ accounts, it’s never been easier or more convenient to make financial transactions with confidence.

- 5% cash back rate on everyday purchases

- No annual fee or foreign transaction fees

- Competitive 2% interest rate on associated savings account

- Exclusive discounts and deals with partnered retailers

Maximize both shopping and savings potential with the new Neo Money™ Card – get yours today!

The Neo Money Card from Neo Financial is a great choice for Canadians looking for an all-in-one financial solution. It offers a 5% cash back rate on everyday purchases, no annual fee or foreign transaction fees, and a competitive 2% interest rate on their associated savings account. Additionally, the card has partnered with several retailers to offer exclusive discounts and deals. With the possibilities of earning rewards while saving money simultaneously, the Neo Money Card is an excellent pick for those searching for flexible and rewarding credit cards.

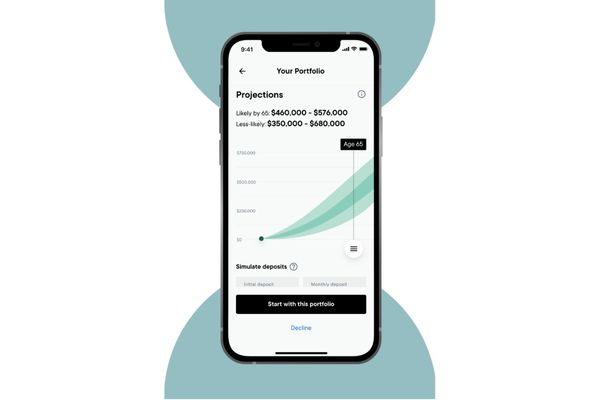

Neo Invest™

The Neo Invest™ addition allows members of Neo Financial to receive private wealth management like customized and professionally managed portfolios. These are actually built around your specific financial situation, risk tolerance, and overall goals. Moreover, you can get up to 3 times more investment strategies and asset classes that protect you from market changes.

Neo Invest allows customers to choose between three accounts, depending on their individual needs:

- RRSP, or Registered Retirement Savings Plan — suitable for those looking to save for retirement and want the benefits of tax write-off contributions.

- TFSA, better known as Tax-Free Savings Account. In other words, this is your everyday investing account with tax-free earnings.

- Personal — investing account with no contribution limits.

Note: You must remember that the Personal account is not a retirement account. Hence, you will not get any tax breaks for contributions made to this account.

Neo Mortgage™

Hang on because there’s more coming from Neo Financial. Their Neo Mortgage™ product offers customers low mortgage rates, refinancing, and renewals.

For instance, Neo’s current mortgage rates for a 5-year variable closed plan are some of the lowest on the market at just 5.69%, closely followed by QuestMortgage at 5.19%.

But why wait? Let’s see how Neo Mortgage™ works:

- It scans the market to find the best mortgage rates.

- Offers rapid and smooth applications in under 5 minutes.

- A human associate handles all applications.

- No in-person appointments for pre-qualification.

- Customers choose their desired lender.

- Fully digital process.

Considering all the above, it’s safe to say that with Neo Mortgage™, you’re in for a stress-free mortgage experience. Their straightforward process will save you time and money—and they’ll be there to help every step of the way.

Neo Financial works with some of the best lending partners in the industry, including:

- CMLS Financial

- Home Trust

- CWB Optimum Mortgage

- Strive

- First National Financial LP

Surprisingly, Neo’s offers aren’t done yet! Let’s see what else the company provides.

Features

The products are not the only thing Neo Financial can boast about. The platform has several valuable and integrated features that make a customer’s life easier. So, what are they?

Spending

The Neo Financial app comes with options that facilitate spending.

Here’s what Neo has on display:

- Neo Card – earn up to 15% cashback on first-time purchases and an average of 5% cashback at 10,000+ partners.

- Neo Card (Secured) – offers an easy credit entry for those with less than stellar scores, guaranteed approval, unlimited cash back, and no monthly or annual fees.

- Virtual Card – the perfect add-on to your physical card, you can’t forget it, and it has no delays + loyalty programs, security benefits, and insights.

- Buy now, pay later – allows you to make payments for purchases in instalments over a scheduled period. (an upcoming feature)

So, this is why the Neo Card was voted as Canada’s Best Cashback card: for the many ways it lets you earn cashback, as you can see from the list above.

Saving

Neo Financial Canada also offers various saving benefits, with the help of features like:

- High Interest – 2.25% on each dollar saved for short-term goals, no monthly fees.

- Payments – helps you track your bill payments with auto-pay, establish recurring payments, and requesting/ sending e-Transfers.

- Money Transfers – helps you move money through Interac e-Transfers, and connect to other money-transfer institutions; plus, you’ll be able to: auto-save, auto-deposit, and auto-invest.

But, apart from saving, Neo gives its customers ample opportunity to invest.

Investing

For members of Neo Financial who are looking to invest, the institution provides a myriad of possibilities to help you achieve your goals, such as:

- Active Management – comprised of industry experts who will manage, track, and update your portfolio.

- Goal Planning – includes professionally-managed goal-based investment portfolios + 3 times more advanced investment tools to enhance diversification and potential returns. Plus, this valuable feature lets you track insights too.

- RRSP Account – enables efficient retirement planning with low fees and high savings.

- TFSA (Tax-Free Savings) Account – helps you make the most of your returns, i.e., to increase them significantly. It also includes a personalized portfolio adjusted to your specific needs.

- Personal Account – it’s about low fees and no contribution limits. And you can improve and custom tailor your investment portfolio and start planning ahead.

- Themed Portfolios – it contributes by personalizing your investing portfolio by selecting a strategy that corresponds to what is most important to you. (an upcoming feature)

- Diversification – lets you achieve return goals while decreasing the risk + protects you from market fluctuations.

Moreover, customers can also take out mortgage loans from Neo Financial, so let’s see how that works.

Borrowing

Since Neo is a digital bank in Canada, it aims to provide everything traditional banks do and more. With that in mind, Neo Financial is gearing towards opening the way for loans and currently enables mortgage purchasing, renewing and refinancing, and home equity with low rates.

Here’s what Neo has put forward:

- Mortgage Purchase – get a new low-rate and low-interest mortgage directly from your device through hassle-free applications and a committed support team.

- Mortgage Renewal – facilitates a mortgage renewal and assesses your current lender against your personal goals and needs for a locked period of 120 days.

- Mortgage Refinancing – helps you get a better deal or access to extra cash based on your equity by connecting with numerous lenders and offering cheap rates.

- Home Equity Financing – HELOC (Home Equity Line of Credit) — is a unique and secure credit line that charges your interest solely on whatever you withdraw. Additionally, it helps you with renovations, debt payments, emergency funds, etc.

Interestingly enough, Neo Financial doesn’t just offer banking features. In fact, the company’s credit cards also provide handsome rewards to all users.

Rewards

By using a Neo Mastercard, customers gain access to a plethora of appealing rewards – which is just one of the many advantages.

Here’s how you can cash in on cashback:

- Cashback Rewards – access to 10,000+ loyalty partnerswith which you can earn cashback at, nationally and locally.

- Marketplace – allows you to use your rewards for experiences, goods from Neo partners, gift cards, travelling, various events, donations, and more. (an upcoming feature)

- Neo Store – cash out to the Neo store to purchase Neo merch and other partner items.

- Referrals – you can get up to 85 dollars cashback if you refer someone to Neo. Furthermore, the people you’re referring the card to will also enjoy a cashback reward.

Amazingly, there are more features customers can take advantage of and enhance their earnings. Let’s take a look.

Additional Features

Believe it or not, that’s not all Neo Financial offers. On the contrary, there are 3 more features customers can use to boost their earnings and expedite their financial progress.

These include:

- Insights & Analytics – you can count on the automated categorization of everyday purchases and real-time notifications (spending, top-ups, etc.).

- Security – it offers card freezing and unfreezing, right from the app, and 2-factor authentication, combined with the ultimate protection from Mastercard Zero Liability, ATB Financial, and Concentra Bank.

- Automations – automate financial procedures such as saving, bill payments, acceptance of Interac e-transfers, investing, and depositing.

Currently, that’s all Neo has put forward thus far. But, if you want to learn how the company’s security system works, read on!

Is Neo Financial Safe?

Undoubtedly, security is one of the essential factors to consider before choosing a digital or traditional bank.

Luckily, Neo Financial is aware of this and only works with trusted partners to protect your future and your money. Some of the names among these trusted partners include Mastercard, ATB Financial, and Concentra Bank (Wyth Financial).

Furthermore, to ensure you, the customers, are receiving the best protection possible, you can also choose to freeze or unfreeze the Neo credit card with a click. One of the best things about Neo Financial is the real-time notifications that notify you about each transaction or purchase.

In terms of account security and access to finances, Neo Financial has incorporated:

- Face ID

- Fingerprint lock

- Two-factor authentication.

Although Neo has taken adequate precautions regarding safety, there are still things that might go wrong. In such situations, is the company’s customer support helpful? Let’s see.

Customer Support

The Neo Financial app and platform offer 4 ways for customers to get in touch. That said, you can get support from this institution through:

- The Help Centre – article sections equipped with handy information.

- Via the Virtual assistant, which is actually a 24/7 chat robot available every day from 7:00 a.m. to 8:00 p.m.

- Via Phone – call 1-855-636-2265 throughout the whole week from 7 a.m. to 8 p.m.

- Email them at [email protected].

Interestingly, apart from the abovementioned contact routes, bank KOHO, for instance, provides its users with an additional email address dedicated to clearing up account fraud – which isn’t the case with Neo.

Nevertheless, Neo’s customers can rest assured knowing their issues are handled attentively and promptly.

Suppose users haven’t gotten a resolution to their problem by contacting customer support. In that case, they are referred to the Chief Complaints Officer at [email protected], who will professionally address any concerns they might have.

And depending on whether you’re experiencing issues with your Neo Card, or Neo Money account, you can also contact the External Resolution Bodies.

Eligibility Requirements and Application Process

This isn’t your regular traditional bank, but that doesn’t mean there aren’t any requirements you must qualify for before getting an account with Neo Financial.

These are the eligibility requirements you must oblige prior to getting a Neo card/account:

- You need to be a Canadian resident (either a permanent or a temporary one).

- Must have a Canadian photo ID.

- Be the age of majority in your province

Note: It’s important to note that Neo Invest is unavailable to Quebec residents.

In contrast, other financial institutions, like Scotiabank, require potential customers to fill out an account application form with all their details as part of their eligibility requirements.

Since we cleared out what are the eligibility requirements you must meet, let’s see how you can apply for a Neo Card.

How To Apply For a Neo Card?

We assume you’ve ticked off all points on the checklist that you qualify for a Neo Card/ account.

But, you have to know that the application processes differ depending on the Neo Card. In fact, to understand better, you can check out Neo’s exhaustive application section for all the necessary information.

And we’ve also compiled a step-by-step procedure on how to apply for a Neo Card. Check out the following steps:

- Go to member.neofinancial.com/signup and click on the Create a profile button.

- You’ll need your email and mobile phone number to create an account

- Once you have the above-requested info, you’ll be shown to a new window with two options: Card and Money.

- However, you need to click on Get started. Now, find the Neo Card option and swipe to it (to the card).

- Finally, click on Apply and follow the further steps.

Once your account is created, you can use your Neo Financial login to access it and manage your finances and transactions.

Want to Consider Other Options?

If Neo Financial’s methods of conducting business piqued your curiosity, but you’re unsure you’re ready to commit completely, here are some alternatives to consider.

Tangerine Bank

The Tangerine Bank is an excellent online banking platform that provides an all-in-one service. The company achieved fame with its credit cards and chequing accounts with no yearly or monthly fees.

Although Tangerine offers various traditional banking products, its interest rates are as little as 0.10%, which rivals Neo Financial’s (2.25%).

However, although Tangerine is predominantly an online bank, it has brick-and-mortar locations for in-person contact. On the other hand, Neo Financial has no such options, i.e., brick-and-mortar locations to offer its customer base.

Scotiabank

Both banks offer free and unlimited e-transfers and transactions with some plans, welcome bonuses, rewards programs, customer privileges, and a 24-hour support line.

Besides these, you also get credit cards, loans, mortgages, and savings accounts from Scotiabank, equipped with financial advice and personal and business banking solutions.

Additionally, you’ll get the same when banking with Neo Financial also. Even better, since they offer a widespread range of banking products and features, among which mortgage renewals, refinance, purchase, etc.

However, when comparing closed-rate mortgages, there are specific differences between these two banks. For instance, Neo offers a 2.65% five-year variable rate (closed). While Scotiabank has something different to offer – a 3.900% five-year fixed mortgage rate (Flex Value).

KOHO

With low fees and free basic service, one can say that KOHO is a trailblazer in the banking industry. The company offers personalized financial coaching, a roundup savings feature, and cashback rewards from 0.5% to 2%. Whereas, with Neo, you can look forward to an average cashback of 5 percent or earn up to 15 percent cash back on the first purchase when shopping at Neo’s partners.

Furthermore, as a budgeting tool, the KOHO app enables users to control their spending better and alleviate purchases and bill payments. This is a valuable asset, and Neo Financial also enables its customers to use it wherever to keep track of their finances.

However, just like Neo, KOHO also has credit cards but with looser eligibility criteria, particularly no minimum credit score. Whereas with Neo Financial, you need to have a credit score of 600 to qualify for a Neo Card. The Neo Card (Secured) is guaranteed approval.

EQ Bank

EQ Bank is a force to be reckoned with, thanks to its 1.65% interest rate on savings accounts, which is consistently among the highest in Canada.

On the plus side, the company doesn’t require banking fees or minimum balance requirements, while fund transfers are straightforward and unlimited. EQ also offers impressive GIC investments, whereas Neo doesn’t.

The company also provides TFSAs, RSPs, joint accounts, attractive referral programs, international money transfers, and low-rate mortgages. On the other hand, you can choose Neo and still enjoy attractive mortgage benefits, excellent referral program, and TFSA account + go ahead and explore their RRSP account too.

Final Thoughts

By sorting through numerous Neo Financial reviews, you can determine that this institution offers a long list of competitive products, excellent and reliable customer service, prodigious security, and a swift application process.

So what are you waiting for? Hop on to the site and become a member of Neo Financial today! You won’t regret it!

FAQ

Yes, Neo Financial is a legal and trustworthy financial institution which operates in Canada.

According to the Neo Financial reviews, the awards, achievements and milestones, plus the satisfied customers, Neo is a good company for users and employees. It has been paving the way toward digital banking and inspiring other companies in the sphere.

The Neo Card (Secured) is guaranteed approval and does not require a minimum credit score.

Yes, Neo Financial’s credit cards are real and accepted anywhere Mastercard is. They provide high cashback rates, especially when shopping at Neo Financial partners.

For starters, you must understand that Neo Financial is a privately owned and funded company. Therefore, its shares are not traded publicly on exchanges.