- Reviewlution Rating: 9/10

- Account Type: Personal

- CDIC Insured: Yes

- Minimum Balance To Waive Fee: $5.000/ $30.000 in Momentum Plus Savings

- Number of Monthly Transactions: Unlimited

Scotiabank Ultimate Package Review: Pros and Cons in 2024

Heads up - there’s a new arrival in the lines of Scotia bank products!

In our Scotiabank Ultimate Package review, you will glance through the basic features, prices, and conditions to obtain the Ultimate membership.

Read on!

- Reviewlution Rating: 9/10

- Account Type: Personal

- CDIC Insured: Yes

- Minimum Balance To Waive Fee: $5.000/ $30.000 in Momentum Plus Savings

- Number of Monthly Transactions: Unlimited

Best For

Unlimited Transactions

Strengths

- Unlimited free transactions

- Free chequebook

- Fee rebates for other accounts

- Rewards for everyday spending

- Physically accessible on 900 locations

- Up to $300 bonus

Weaknesses

- Pricey monthly subscription fee

- High minimum balance to avoid a monthly fee

- Additional welcoming bonus conditions

What is The Scotiabank Ultimate Package?

Founded in 1832 in Halifax (now centred in Toronto), Scotiabank has deeply rooted among Canadians of various backgrounds, ages, and social classes. Scotiabank has provided many rewards to its customers over two decades – but safety and security are undoubtedly the most appreciated.

Scotiabank is crowned ‘Canada’s most international bank‘ with more than 10 million users worldwide and free ATM withdrawals throughout the globe.

But what is The Ultimate Package of Scotiabank, and what’s so special about it?

The Ultimate package of Scotiabank is a chequing account, but it could also be linked to other Scotiabank accounts and boost your monthly interest rate on your Scotia savings account.

It is specially created for travellers, families, and anyone who wants to get the most out of their banking. You’ll recognize some popular features in other Scotia chequing accounts. Such as unlimited free transactions, free credit scores, and senior account discounts. But, you’ll also be introduced to a whole new set of perks, which we will cover in the section below.

Scotiabank Ultimate Package Features

With Scotiabank, there is a fee to pay for all the fantastic bonus perks, such as unlimited eTransfer volume, free overdraft protection, and a free deposit box for your valuable belongings.

The monthly $30.95 might seem a bit off the limit for people who can’t maintain their banking account above $5.000.

In addition, here are some of the main add-on features included in this package.

Unlimited Transactions and Interact e-Transfers

One of the best things about the Scotia Ultimate package is the transaction freedom you get. By signing up for the Ultimate package of Scotiabank, you can avoid wire transfers and transaction fees.

The e-Transfer limit for sending funds through a Scotiabank Ultimate account is $25.000. But, there is no limit on the amount you can receive, and the funds are typically available within minutes.

Numerous Physical Bank Locations

With 900 accessible locations across all Canadian provinces, it’s one of Canada’s most reachable financial institutions. In comparison, Fairsone bank only has around 240 available locations within the entire Canadian territory!

On the plus side – you’ll get FREE advising with some of their agents as a user of their Ultimate package! There are also nearly 3,600 ATMs on Canadian grounds, and there is no international Scotiabank withdrawal limit.

Cashback on Premium Credit Cards

Since you’ll be entering a higher level of Scotiabank members by purchasing the Ultimate package, you’ll be free to choose and link some of the premium credit cards to Scotiabank. They all offer different privileges and perks, as explained:

- Scotiabank AA Black – get a complete reimbursement in case of lost luggage up to $3.000 and collect one AAdvantage mile for every $1 spent.

- Scotiabank AERO Platinum – to enjoy travelling carelessly with each airline and get a cashback of one Scotia Point on every $1 spent.

- Scotiabank AAdvantage – enter the world’s most famous travelling cashback program, and earn one AAdvantage mile for every $1 spent.

- Scotiabank Gold – every purchase saves a cashback for you, and on an annual basis, you can get 3% off on gas stations, 2% in pharmacies and 1% everywhere else.

Keep in mind all the offered cards and choose the one that suits you best.

Free Safety Deposit Box

These boxes are a convenient way to keep personal belongings or finances aside. By signing up for the Ultimate package, you are automatically granted a free safety deposit box (1.5″ x 5″ x 24″), which is listed as box A (the smallest deposit box) on the list of 7 different sizes available.

You also waive a fee of an estimated sum of $60 yearly, as well as a free place for your most precious valuables.

Free Overdraft Protection

Being an Ultimate member allows you to have a negative balance without paying penalties. This feature usually comes as a monthly or regular addition, such as with Simplii Financial.

It can be a valuable service for those who occasionally find themselves in a tight spot and an excellent backup plan for unplanned expenses. However, Ultimate account holders are still expected to repay any negative balances in a timely manner. Considering that the interest rate on overdrawn funds is around 21%, it’s in your interest to balance these funds as soon as possible.

A handy feature of Scotiabank’s overdrafts is that you can get them in any transaction you feel fit, but it stays within the legally proclaimed frame of allowed funds, which is $250 – $5000.

Scotiabank Rewards

There are 2 very tempting and generous reward offers to look forward to as an Ultimate Scotiabank member.

New Member Bonus of $300

One huge asset of the Ultimate package is the opportunity to get a $300 bonus just by registering (with Tangerine Bank, you can get up to $400 as a new member)! However, not all applicants are granted the chance to receive these funds.

Before receiving the bonus, two of the following conditions must be met within 50 days of opening your Scotia Ultimate account:

- Make an eligible $50 transaction through mobile/online banking.

- Set up and clear at least 2 eligible separate recurring pre-authorized $50+ transactions (that will recur monthly for at least 3 consecutive months).

- Set up and clear at least one automated and recurring direct deposit (payroll, pensions etc.) that will also recur for no less than 3 consecutive months.

If all of the offer’s requirements have been satisfied, you will be deposited the $300 cash bonus into your new Ultimate Package account within 6 months of the account opening date.

Scene+ Scotiabank Rewards

Travel, banking, dining, shopping and other entertainment are at your glance with the Ultimate membership in Scotiabank. If some of your cards are linked with a Scene+ membership – you can collect and redeem Scene + points.

Each $5 spent on a debit or Interac eTransfer transaction is accumulated directly and can be exchanged for a travel ticket or used as a payment in many restaurants and shops around Canada and USA. The collection of Scene+ points is an exclusive feature of Scotiabank, which can’t be found in any other Canadian bank.

Scotia iTrade Benefits

The Scotia iTrade promotion and credit for trades is a fantastic bargain included within the Ultimate package. Especially when you consider that you may get 5 continuous trades each next year when continuing your Ultimate package. In contrast, in the first – you’ll get 10 great free trades (estimated to be $100 in savings). Their recently added new feature to the package includes an extended list of ETFs you can trade – absolutely for free!

You’ll also get access to free tools to teach and promote your future investments at low commission rates on the Scotia iTrade platform.

Exclusive Rates on Other Scotiabank Packages

If you’re an existing customer – you might miss the chance to earn a $300 bonus. But you’ll get excellent features for your other accounts.

For example, if you’re using a Momentum Plus Savings Account, you can boost your interest rate with an extra 0.10% of your regular interest rate and can also earn a limited time savings rate of up to 4.05%. And if you use the Scotiabank Preferred Package, you’ll be boosting up to 4% of your regular interest rate.

Discount On Cheques and Bank Drafts

If you have a significant financial investment or payment, you’ll be happy to hear about the unlimited Scotiabank bank drafts included in the Ultimate package. They apply to CAD and USD currency and the only condition is the bank’s evaluation of your account to be ‘ in good standing.’

Aside from these safe and secure transactions to go beyond your cheque, you also get a free personalized chequebook containing 100 cheques each year round.

Scotiabank Fee Waiver

As mentioned in the beginning, all the perks come with a price of $30.95 – but this can also be waived! You can get the entire package and all the perks for FREE if you maintain a daily balance on your account of $5.000+. Or, you can go below this limit if you have at least $30,000 in your Momentum Plus Savings account (or combined with your Ultimate account balance).

One of the perks when using Scotiabank Ultimate is the fee waiver you can get on your premium credit cards:

- The Scotiabank Passport Visa Infinite Card

- The Gold American Express

- The Scotia Momentum Infinite

- The Scotiabank Value Visa Card

You can get up to a $139 waiver on fees regarding these premium cards. But you can only use these perks on one credit card. So choose wisely.

Eligibility and Application Process

Are you wondering how you can get the Ultimate Package?

Luckily, it’s quick and easy! The first step is to choose one of the TWO registering options. It means you can register an account in person in one of the physical bank locations or do it online.

Moreover, their eligibility requirements are straightforward:

- At least 16 years of age

- Canadian residence or a working/studying permit

So if you meet all the criteria, the application process itself is as follows:

- Follow the link and enter your basics – name, birthday, address, social insurance number, and contact information.

- Create a username and password – the same credentials will be used once you receive your card and start online banking.

- Verify your account – you’ll be asked to confirm the credentials with an existing bank, account credentials, or your ID/permit/ driving license.

You can conduct this operation through the Verified.Me app, which helps you verify your identity using your Scotiabank info when applying for products and services like a bank account or phone plan.

The online registration will take about 8 minutes, and you can do it all from the comfort of your home.

Want To Consider Other Options?

So checking something out and reading all about its perks doesn’t necessarily mean you should pick it. Thus, there are similar alternatives to this product and their pros and cons in comparison.

BMO Plus Plan

When we compare these two advanced chequing account options, the first thing to catch your eye is the significant price difference. BMP plus comes for a monthly fee of $11.95 – three times less than the $30.95 for the Scotia Ultimate package.

However, with the lower price comes a lighter package of services and limited options with BMO. You only have 25 monthly transactions, which makes this plan even pricier when you compare the perks you are getting.

HSBC Premier Chequing Account

Is your biggest obstacle the Scotiabank monthly fee? If so, the fact that other similar packages come with a higher price and bigger monthly deposit/investment requirements might be relieving. If you don’t meet the $100,000 minimum account balance criteria with the HSBC Premium package, you’ll be charged $34.95 monthly.

At the same time, you can avoid the monthly subscription if you are a Premier member of HSBC in other operating countries.

Simplii No Fee Chequing Account

One of the best alternatives for everyday transactions, bill payments and pre-authorized deposit purchases is the free chequing account by Simplii Financial.

No monthly fees and no account minimum – and you get a $350 bonus if you’re a new customer! Transferring funds through accounts is also included. But the overdraft protection costs around $5 per month and has a high-interest rate of around 19%. With the Scotia Ultimate package, you get this feature without additional payments.

So, if you want to make everyday online banking easier but don’t care about trading, investment rates or cashback points – the Simplii No Fee account is your best alternative.

Other Scotiabank Packages

Since we’ve already compared similar products, let’s compare the Scotiabank Ultimate package to other Scotiabank offerings.

| Ultimate | Preferred | Basic Plus | Basic | Student Banking | |

| Monthly Fee | $30.95 | $16.95 | $11.95 | $3.95 | None – with proof of enrollment at a post-secondary institution |

| Minimum Balance To Waive Fee | $5.000 | $4.000 | $3.000 | None | None |

| Debit Card Transactions | Unlimited | Unlimited | 25 per month | 12 per month | Unlimited |

| eTransfer Transactions | Unlimited | Unlimited | Unlimited | Unlimited | Unlimited |

| Senior Discount | $4 | $4 | $4 | $3.95 | Not Available for Seniors |

| Bonuses | $300 | $300 | None | None | $75 |

| Scene+ Points | ✔ | ✔ | ✔ | ✔ | ✘ |

| International Money Transfer | Free | From $1.99 | From $1.99 | From $1.99 | From $1.99 |

Now that we have highlighted the packages’ Scotiabank features, it is up to you to choose the one that suits you best.

Finishing Thoughts

If you enjoy travelling and want to overcome the financial barriers created by ATM withdrawal fees and conversion rates, you will be the perfect Scotia Ultimate customer. Earning and redeeming Scene + on every $5 spent is meaningful for spenders and cash flow enthusiasts. Moreover, if you’ve never registered a Scotia chequing account before – you’ll get a generous $300 bonus!

But, if you’re interested in passive interest income and a classic savings account – this might not be your best option.

FAQ

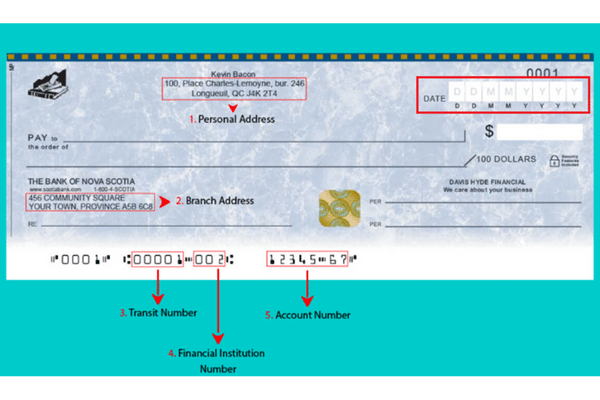

Each cheque has its specific requirements and fill-in standards. Since there is a lot to discuss on this particular subject, here’s an image for your better understanding.

Similar to other financial institutions, requesting a bank draft at Scotiabank can be done online or by visiting some of the 900 physical bank locations in Canada. Then the funds will be transferred from your account to one of the bank’s accounts and transferred to the payee.

With 2 centuries in banking and CDIC insured (up to $100.000), as well as 128-bit SSL encrypted added to accounts, Scotiabank is safe and secure.

As mentioned in our Scotiabank Ultimate package review, a minimum of 16years of age and a Canadian residency or working permit are necessary. Furthermore, you’ll need proof of your credentials, such as a valid ID, driving license or a previous bank account copy.