What Is a T4E in Canada?

Tax season will soon be upon us, and with that comes a twinge of confusion, especially for new taxpayers. And if you’re employed or have received benefits from one of the many assistance programs during COVID-19, you’ll also need to include a T4E tax slip.

So what is a T4E in Canada, and how do you know if you should include it in your next filing?

Read on for all the answers!

What Is a T4E?

Before you learn all the details concerning the T4E form, let’s explain what the slip even is.

Essentially, the T4E is a Statement of Employment Insurance and Other Benefits slip used for tax purposes. Namely, Service Canada uses T4E slips to tell you and the Canada Revenue Agency (CRA) the gross amount of benefits you got for the previous tax year, the income tax deducted, and overpayments.

By filling out these forms, you will outline the gross amount of benefits you’ve received either from:

- Employment Insurance (EI) benefits

- Canada Emergency Response Benefit (CERB) payments

- Repaying an overpayment from a previous year

Evidently, T4E slips are relevant for 1 calendar year, i.e. from January 1st to December 31st. Therefore, you’ll have to file the form with your income tax return for that tax year.

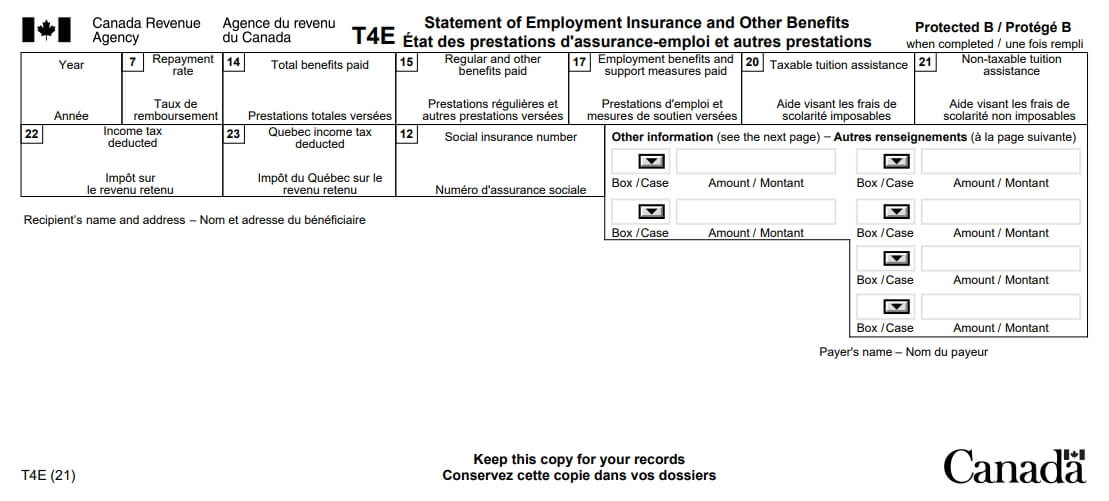

Here’s a T4E slip sample photo directly from the Government of Canada to help you understand the form before receiving and filling it out:

For residents of Quebec as of December 31st, you will receive a T4E(Q), which is basically the same form but with an additional copy to attach to the provincial tax return.

Where to Get the T4E?

Since this slip is an addition to your tax file, you can get it if you log in or register for a My Service Canada Account (MSCA). There, you can access the T4E slip online, view it, print it, and submit a copy of it with your tax return.

If you don’t want to get the slip online, you can get it mailed to you. If you choose this option or if you didn’t pick any delivery option on your EI application, you’ll receive the T4E by February 28th. However, if you haven’t received it by the middle of March, contact the Service Canada Employment Insurance Program.

The deadline for sending in your T4E slip corresponds to the one for your tax return paperwork, so keep tax season dates in mind.

Understanding T4E Boxes

By looking at the sample photo above, you can tell that the T4E form includes several numbered boxes requiring certain information. Each box allows you to add income sources and explain your assets and benefits to Service Canada. Here’s what they all mean:

- Box 7: Repayment rate – T4E box 7 will usually state a percentage rate of repayment (like 30%), which means you’ll have to calculate how much of your EI benefits you need to repay.

- Box 14: Total benefits paid – this box should include the benefits you earned in the previous year but paid in the year for which you’re filling the slip and consists of the amounts shown in boxes 15, 17, 18, 33, and 36.

- Box 15: Regular and other benefits paid – T4E box 15 consists of work-sharing and income benefits from the EI Act and this amount is included in box 14.

- Box 17: Employment benefits and support measures paid – box 17 includes paid financial assistance funded by employment insurance while taking part in an approved employment program and is covered in box 14.

- Box 18: Tax exempt benefits – this is where registered and eligible Indians can include the Indian Act, while this is also encompassed in box 14.

- Box 20: Taxable tuition assistance – this box should have your tax credits and be included in box 14, 17, or 33.

- Box 21: Non-taxable tuition assistance – here you should include the amount that does not qualify for a non-refundable tax credit and add it to box 17 or 33.

- Box 22: Income tax deducted – this amount should be added to line 43700 of your tax return

- Box 23: Quebec income tax deducted – this box should have the amount on your Quebec provincial return if you were a resident of Quebec on December 31st, and if you were a resident of another province and territory, enter this amount on line 43700 of your federal return.

- Box 24: Non-resident tax deducted – another amount that should be on line 43700

- Box 26: Overpayment recovered or repaid – this box consists of the amount recovered from benefits paid or any cash or returned warrants applied to an overpayment and should be included in box 30

- Box 27: Reversal of income tax deducted – here you should add the reversal of the income tax deducted from a repaid amount and is included in box 30.

- Box 30: Total repayment – box 30 includes the total of boxes 26 and 27 and helps to determine the amount to report on line 0 of the repayment chart.

- Box 33: Payments out of the consolidated revenue fund – another amount that should be added to box 14.

- Box 36: Provincial Parental Insurance Plan benefits – this amount should also be included in box 14.

- Box 37: EI maternity and parental benefits payment – another amount included in box 14.

As you can see, the T4E slip might get confusing for someone who hasn’t filled it out before. But by following our explanations, you’ll crack the code in no time.

T4A vs T4E Slips

Because the T4A and T4E slips have such similarly sounding names, differentiating between them may be frustrating. However, to ensure you’re effectively filling out each form, you must be able to tell them apart.

So, what’s the difference?

As you already read, the T4E form is meant to show the CRA and Service Canada the gross amount of benefits paid to you, any applicable income tax deduction, and any relevant amount paid toward an overpayment.

On the other hand, a T4A, also known as the Statement of Pension, Retirement, Annuity and Other Income, is another tax slip that’s issued by payers of other amounts connected to employment, such as pension payments, self-employment commissions, bursaries, annuities, retiring allowances, research grants, scholarships, and the like.

How to Report the T4E on Your Tax Return?

Lastly, let’s talk about reporting your benefits on a T4E.

Since you already know that the total amount of Employment Insurance benefits paid to you sits in box 14, the first thing you’ll need to do is double check the amount. Although the numbers are rarely inaccurate, you should verify to ensure there’s no issue.

Then, look at box 14 and find your total benefits paid amount. If you’re not protected under the Indian Act and aren’t elibigle to receive tax exempt benefits, subtract the amount in box 18 from box 14 and then enter that amount in line 11900 on your tax return.

That’s it – you’ve successfully reported your benefits and you’re ready to send in your tax return!

Conclusion

After such a detailed guide about the T4E in Canada, we hope you won’t be flustered when you see the slip in your account.

Ultimately, the T4E form is a way for the government to understand your financial situation and determine how much you’ve received in benefits. Having everything essential in your tax return makes life easier for everyone, doesn’t it?

FAQ

If you want to receive your T4E slip online, you’ll need to log in or register for a My Service Canada Account (MSCA). The slip will be available as early as February, but if you don’t get it online, you can have it mailed to you.

The T4E repayment rate in box 7 is a calculation of how much of your employment insurance benefits you’ll have to repay. To calculate the amount, you’ll need to complete the repayment chart on your slip.

Although unlikely, it’s possible for your T4E form to include incorrect information. In this case, you have to get an amended (replacement) slip issued by your employer and check the new information before sending it in.

If all the information on your T4E slip is correct and you do not owe any amount, you don’t have to pay anything back. But if you’ve received more benefits than what you were entitled to, you’ll have to repay the difference.

The T4E includes EI, CERB, or other benefits a taxpayer has received during the tax year, while a T4 (Statement of Remuneration Paid) includes the income you earned while working for an employer such as salary, bonuses, gratuities, vacation pay, tips, commission, or wages.