When are Taxes due in Canada? The Essential Dates

How come they never teach you how to pay taxes in school? They always seem to skip the important stuff, like ‘When are taxes due in Canada?’ or ‘How do I pay less for taxes to save up some money?’. We’re just asking the important questions here.

Luckily though, we’ve managed to dig up some details on all the tax due dates in Canada so that you don’t have to. Read on to find out.

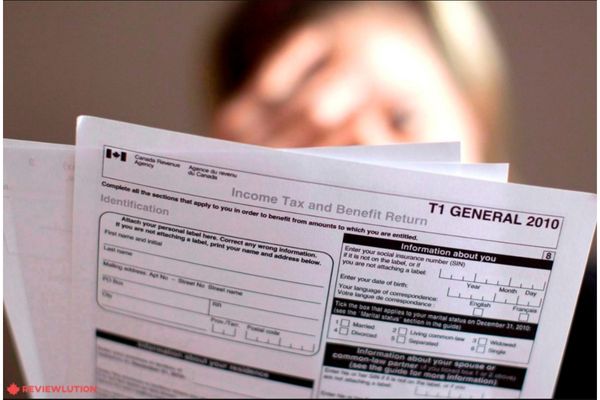

Canada Tax Deadline for 2022

Taxpayers across the country need to stick to strict due dates and deadlines appointed by the Canada Revenue Agency. Filing your taxes in time helps you avoid penalties or interest rates, both of which may put a strain on your budget.

Individual Tax Returns

Filing for 2021 individual tax returns is open until May 2nd, 2022. Most taxpayers are expected to send their submissions by April 30th of each year. If the date happens to be on the weekend, the tax deadline is extended until the following business day.

If you want to send in your submission as soon as possible, the Canada Revenue Agency’s NETFILE service opens on February 21st. This feature allows you to submit your income tax returns electronically, with lots of time to spare.

Those who want to mail your tax returns, make sure they’re received or postmarked by the Canadian tax returns due date. Your submission won’t be valid if you miss the appointed deadline.

You may be interested: What’s the Population of Canada?

Self-Employed Tax Returns

Self-employed taxpayers have a little more leeway for submissions – you can do so by June 15th, 2022. You won’t be subjected to any penalties within that time frame.

However, the CRA will start assessing your interest on unpaid taxes as of May 3rd, 2022. Should you fail to pay off what you owe in the allotted time and you end up exceeding the tax filing date, you’ll be charged with additional expenses accordingly.

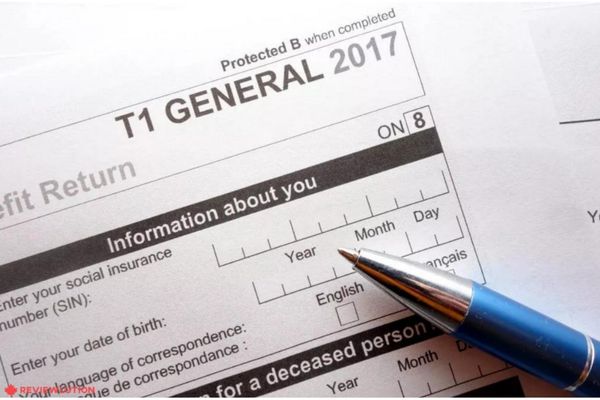

Important CRA Dates and Deadlines Overview

- January 19th – open a CRA My Account to submit your tax return

- February 21st – online submissions via NETFILE become available

- March 1st – RRSP donations/contributions deadline

- March 15th – CRA auto-fills your return form with your data

- May 2nd – tax return deadline

- June 15th – self-employed tax return deadline

Things to Have in Mind Regarding the Tax Deadline in Canada

Let’s go over some important things to consider when doing your taxes in Canada.

Missing the Deadline

Here’s the thing – submitting your taxes late when you don’t actually owe anything won’t result in additional fees or penalties. But if you fail to meet the tax deadline in Canada while having an unpaid balance, the CRA will charge you with a starting interest of 5%, along with an additional 1% for each passing month.

If you’re required to pay tax installments, you‘ll have to pay off each one by its due date. Missing any of these deadlines will result in a corresponding installment interest, which may pose a financial challenge if you haven’t paid off your initial debts either.

Pro-tip – to stay on top of your deadlines, installing the CRA mobile app might help you keep track of all your data. Once you download it, you can set reminders for every due date on your schedule so that you don’t face a late filing penalty.

Waiving Tax Return Interest

Fortunately, you can avoid a late filing penalty by the CRA if you’re unable to pay off your debt because of circumstances that are out of your control. To do this, you’ll have to fill out a relevant request form with all of your details. It’s worth noting that the CRA only offers relief on taxes within a 10-year time span prior to your request.

False or Double Reports

You’ll likely be subject to federal or provincial penalties if you make any false statements or omissions in your tax refund submission. The charges range from 10% to 50% of the amount you failed to disclose.

Once again, CRA can grant you relief if you voluntarily come forward with the exact amount you haven’t disclosed. In other words, by reporting the issue before any officials contact you, you won’t be charged with CRA interest or penalties.

You may be interested: Gasoline Prices in Canada

COVID-19 Related Interest Relief

Similarly, you may take advantage of interest relief on your 2020 taxes due to the newly-implemented COVID-19 benefits. There are several eligibility criteria you need to meet in order to be granted relief, including:

- Having a taxable 2020 income of $75.000 or less

- Receiving at least one COVID-19 benefit

- Having filed your 2020 income tax and benefit return

Bear in mind that the CRA late filing penalty is still applicable, regardless of whether you meet the criteria for the relief or not. Moreover, other penalty charges might be assigned if necessary since they’re not inherent parts of the grant.

Finishing Thoughts

Without a doubt, filing or paying off your taxes is quite stressful and challenging, particularly if you’re not familiar with the relevant deadlines and due dates. The easiest way to manage this would be to keep a record of your income throughout the year and give yourself plenty of time to do your taxes. This, in turn, helps you avoid extra costs and unnecessary debt.

FAQ

Missing the tax return deadline in Canada means that you’ll be charged with a late filing penalty and interest charges on the amount that you owe. The longer you wait, the higher those charges will be.

Not filing your taxes in time is actually considered a crime, which means you’ll be forced to pay a fine. So if you’re wondering when are taxes due in Canada, it’s best if you check the due dates to avoid tax evasion charges.