How to Do Day Trading in Canada: A Step-By-Step Guide and Practical Tips for Success

| 📖 Day Trading Defintion

Day trading involves trading financial assets within the same trading session or a short period. These assets include a wide range of financial instruments. They comprise stocks, ETFs (Exchange-Traded Funds), and foreign exchange currencies and may extend to cryptocurrencies. |

For years, it has become widely recognized that there are financial opportunities in the stock market. Many individuals turn to stock investments and other financial markets to maximize their returns.

Moreover, you can purchase and trade the stock market directly through your bank. Numerous apps and online brokerages, including some of the best Canadian stock trading apps, enable you to manage your stock and investment transactions.

The process of investing has become much more accessible, eliminating the need for a financial advisor. This convenience has contributed to a surge in interest in day trading.

Fortunately, this article outlines the step-by-step process of how to do day trading in Canada.

🔑 Key Takeaways:

|

Step-By-Step Guide on How to Day Trade in Canada

In Canada, day trading has regulations to make it easier for individuals to enter and participate in day trading activities. Regulations may involve:

- Lower minimum capital requirements

- Fewer restrictions on pattern day trading

- Potentially more lenient tax treatment for active traders

User-friendly trading apps are also available to execute trades directly from your smartphone. These apps also provide insights into stock trends, helping you decide where to invest your money.

Getting started with day trading is easier than you might think. It only requires a brokerage account, a starting capital, and a basic understanding of market mechanics.

| 💡 Did You Know?

Investing as a teenager in Canada is possible. This can provide valuable financial advantage and insights to serve the younger generation in the long run. |

If you are ready to begin your day trading in Canada, these steps will ensure your success:

Step #1: Learn the Basic Strategies

Several approaches can assist you in navigating the trading markets. While it does not represent all day-trading strategies, these are the basic and practical ones:

1. Price Action

Price action focuses on analyzing an asset’s price movement on a chart to make trading decisions. It relies on the belief that prices reflect all relevant market information.

Here are some critical points about price action as a day trading strategy:

It is important to note that while price action can be an effective strategy, it requires practice and experience to become proficient.

2. Scalping

Scalping combines fundamental and technical analysis to capitalize on minor price changes in the market. Frequently, positions are held for minutes or seconds, with the primary goal of quickly selling it for a profit. It makes a well-defined exit strategy essential.

3. Trend Following

Day traders employing this strategy follow prevailing trends and ride market momentum. They use trend, momentum, and volume indicators to go long when prices rise or fall short.

4. Counter-Trend Trading

Counter-trend trading involves intentionally placing trades against current trends. It relies on the belief that an asset’s value will reverse its direction or stabilize at a particular price point.

5. Fundamental Trading

Fundamental trading is often referred to as fundamental analysis. It is a strategy that involves studying critical economic indicators and financial figures to buy or sell decisions. It is commonly used in longer-term investments but can also be adapted for day trading.

Here’s an overview of fundamental trading:

Thoroughly research and practice fundamental trading before committing to real capital. Consider seeking advice from experienced traders or financial professionals.

6. News Trading

Day traders perceive news events as valuable data sources. They value any information impacting stock prices, encompassing everything from new product announcements to industry rumors, and day traders use this information to make strategic decisions.

7. Technical Analysis

Technical analysis studies the historical price and volume data to predict future price movements. Traders who use technical analysis, often called “technicians,” believe that market trends, patterns, and indicators can provide insights into potential price directions.

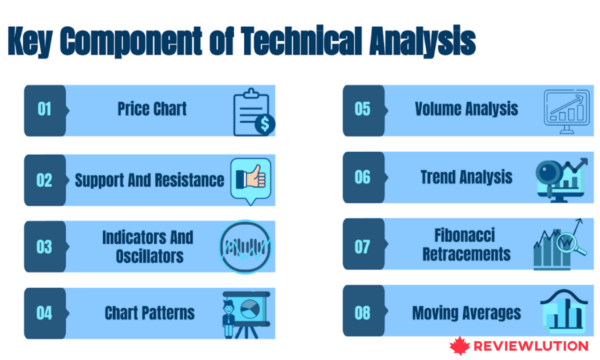

Critical technical analysis components include:

Technical analysis is subjective and can involve a certain level of interpretation. It is best to stay updated with market news and events as they can impact price movements.

8. Contrarian Investing

Contrarian investing is a strategy that goes against the prevailing market sentiment. It seeks to identify undervalued stocks or assets in the day trading context. Contrarian traders often look for opportunities to buy when others are selling (during market dips or negative news) and sell when others are buying.

Also, contrarian traders analyze technical indicators like moving average, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) to identify potential reversal points.

Moreover, timing is crucial as they should wait for entry and exit points and be patient when market sentiment shifts.

| ✅ Pro Tip:

Set straightforward entry and exit points before making a trade. A plan helps you avoid emotional decision-making and stick to your strategy. This increases your chance of making profitable trades. |

Starting slowly and gaining research experience are crucial aspects of these strategies. Refraining from jumping directly into day trading without developing these skills beforehand is highly recommended.

Step #2: Know the Risks

Day trading has the potential for gain and equal risks. Therefore, conducting thorough research before buying stocks or selecting a market to invest in is vital.

Here’s what you should consider when engaging in day trading:

- Dedicate time to research

- Study the market and how it behaves

- Choose a day trading strategy

- Be mindful of trading fees

- Prepare yourself for some lump and losses

- Understand your investments

- Do not hesitate or get too greedy

- Be prepared for stress

Day trading involves a significant commitment of time and effort. Your success depends on thorough research, understanding of the market, and preparedness for the stress of this type of trading.

| ✅ Pro Tip:

Start with a small amount of capital you can afford to lose, especially if you’re new to day trading. It takes time to develop the necessary skills and strategies for consistent success. |

Step #3: Tax Implications

Calculating your annual income or loss is essential as a day trader. The process resembles filing business income, where any assets you own are considered inventory until sold.

Remember that your income from day trading is subject to total taxation at your nominal tax rate. The silver lining is that your day trading losses are fully deducted against your employment income, along with related expenses.

To navigate the complexities of taxation, seeking guidance from a tax professional is always prudent. Additionally, it’s essential to factor in currency conversion implications. If you have any US Dollars losses, convert them to Canadian Dollars for tax purposes.

If you plan to claim tax deductions, ensure the necessary receipts are ready for presentation.

| 📝 Note:

Following these guidelines, you can better manage your day trading financials and navigate the tax requirements effectively. |

Step #4: Familiarize the Day Trading Process in Canada

Day trading in Canada provides accessibility to anyone, enabling the execution of multiple transactions. Nonetheless, the accumulation of trading fees can be quick. It is advisable to be familiar with the process and utilize discount brokerages to mitigate these costs. Doing so will allow you to retain more of your capital gains.

Here’s a step-by-step overview of the day trading process in Canada:

1. Sign up for a free brokerage account at any Canadian discount brokerage you choose.

| ✅ Pro Tip:

One of the most popular trading platforms in Canada is Wealthsimple. Its popularity stems from its ease of use, low fees, and positive reviews, giving confidence to traders seeking reliable platforms. |

2. Deposit funds into your newly created trading account after completing the registration.

3. Familiarize yourself with reading stock charts and gain some basic knowledge of technical analysis.

4. Experiment with trades in a practice or paper trading account to practice and refine your skills.

5. Once you have gained confidence and achieved success, you can transition to using real money in the stock market.

Remember that before becoming a full-time day trader, wait until you have established a consistent income from your trading activities.

While day trading rules in Canada offer a degree of leniency, you must adhere to specific regulations to maintain market integrity. Regulation ensures a structured and fair trading environment, safeguarding individual investors and the broader financial system from potential risks.

Superficial Loss Rule

Canadian day traders must familiarize themselves with the Superficial Loss rule, which holds importance in their trading practices.

Any loss suffered within 30 days of selling stocks cannot be claimed as a capital loss when filing income taxes. This rule is commonly referred to as the “30-day rule”. Its regulation covers the 30 days following the sale and the 30 days preceding it.

Its purpose is to discourage traders from selling a stock to realize a capital loss and repurchasing the same stock. This tactic is an attempt to exploit tax benefits.

By enforcing this rule, the Canada Revenue Agency aims to maintain fairness and integrity in the taxation system. This prevents undue manipulation and ensures accurate capital gains and losses reporting.

Final Thoughts

Engaging in day trading within the Canadian financial industry holds potential for individuals seeking an active role in market transactions.

Understanding strategies helps traders make informed decisions, optimize their investments, and achieve better outcomes. Adhering to regulations ensures fair and transparent markets, prevents fraudulent activities, and maintains investor confidence in the trading ecosystem.

Also, combining strategic understanding with regulatory compliance enhances both individual trading success and the integrity of the trading environment.

FAQ

The average income of a day trader in Canada can vary widely, ranging from $97,114 or more annually. It depends on the skill level, market conditions, and even the time and effort of a day trader.

In Canada, pattern day traders should maintain a minimum account balance of $25,000. If you do not meet this requirement, you may be limited in the number of day trades you can make.

Selecting the right stocks for day trading requires careful analysis. Focus on liquid and volatile stocks with sufficient trading volume to ensure smooth execution of trades.